In this brief market report, we look at the various asset classes, sectors, equity categories, exchange-traded funds (ETFs), and stocks that moved the market higher and the market segments that defied the trend by moving lower.

Identifying the pockets of strength and weakness allows us to see the direction of significant money flows and their origin.

The mid-summer selloff

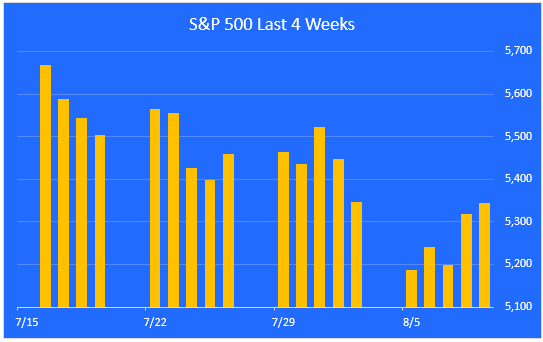

The S&P 500 notched its 38th record high on July 16, reaching 5667. Since then it's been a downhill slide with the market giving back 5.7% in the last four weeks. In a typical year, the market makes 14 new highs over the full year. Here's a look at the last 4 weeks.

A look at monthly returns.

This chart shows the monthly returns for the past year. August is off to a shaky start. Bear in mind that pullbacks of 5% or so are common during bull markets.

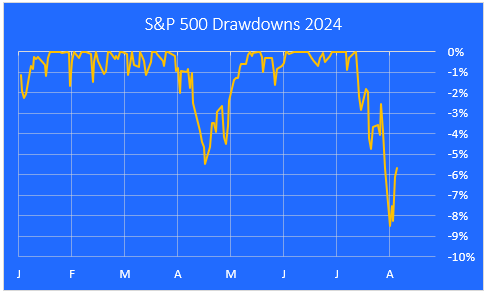

A look at the July selloff.

Here is a closer look at the July decline, using a drawdown chart. The maximum drawdown so far is 8.5% from the peak on July 16.

A look at the bull run since it began last October.

This chart highlights the 49.4% gain in the S&P 500 from the October 2022 low through Friday's close. We have dipped below the trendline and it looks like we may have further to fall before this pullback is over.

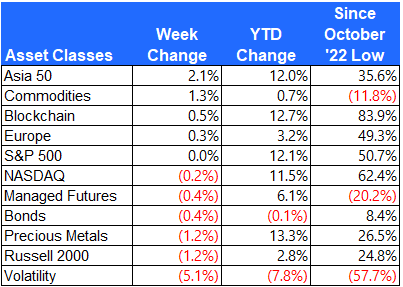

Major asset class performance.

Here is a look at the performance of the major asset classes, sorted by last week's returns. I also included the returns since the October 12, 2022 low for additional context.

The best performer last week was the Asia 50 index. Taiwan Semiconductor makes up 25% of the index, and TSM had a good week. The worst performer was Volatility, as the VIX index first spiked, then fell from its high . Small caps had a rough go of it, giving up 1.2% for the week.

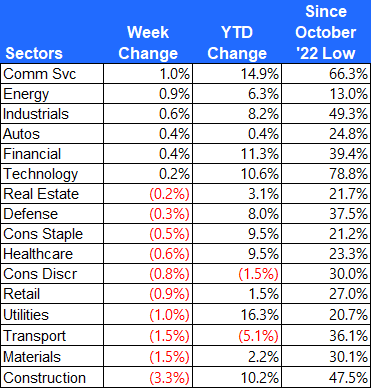

Equity sector performance

For this report I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. This gives us added granularity as we survey the winners and losers.

Communication Services had a good week, thanks to a 6.1% gain for META. Home Construction stocks gave back a portion of their recent gains, possibly as a reaction to sharply falling mortgage rates which could rekindle the existing home market.

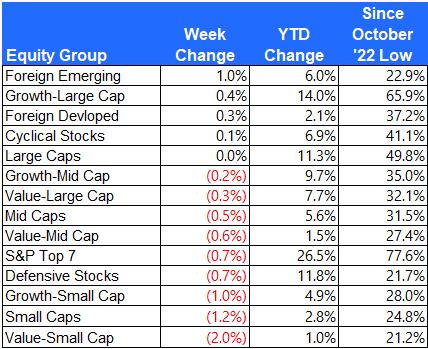

Equity group performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

The best performing groups last week were found outside of the U.S. Small caps got hammered, giving back a sizable chunk of their recent gains.

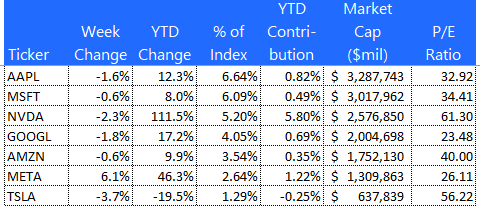

The S&P Top 7

Here is a look at the seven mega-cap stocks that have been leading the market over the past year. These seven stocks account for 56% of the total YTD gain in the S&P 500. That's down from 87% at the start of the year, providing evidence that participation in the bull market is broadening. META was the big winner while TSLA can't seem to get back on track.

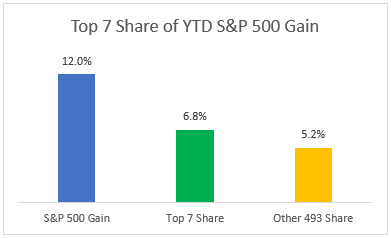

The S&P Top 7 dominance is fading

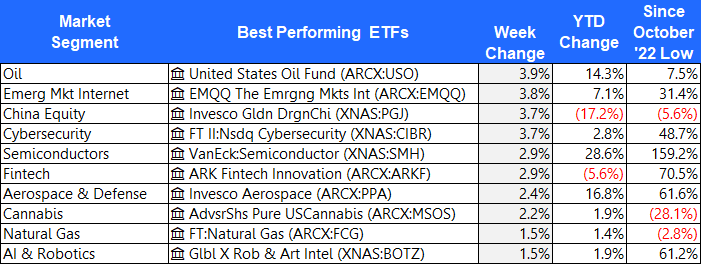

The 10 best performing ETFs from last week

Oil, China and Cybersecurity all performed well, as did Emerging Market Internet stocks.

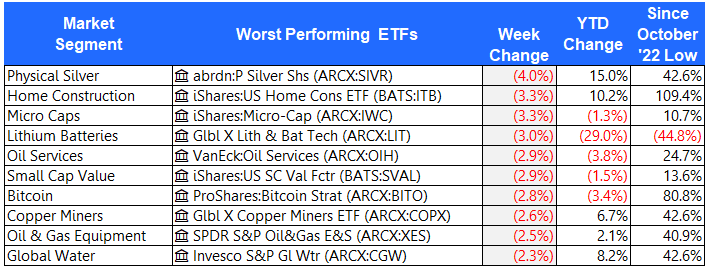

The 10 worst performing ETFs from last week

Silver gave back some of its recent gains, while Home Construction and Micro Caps saw heavy selling.

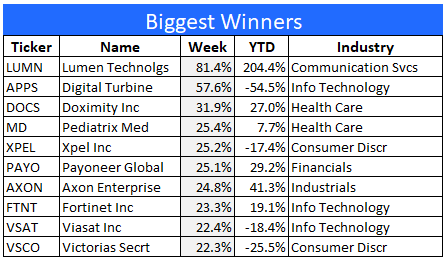

The 10 best performing stocks from last week

Here are the 10 best performing stocks in the S&P 1500 last week. Lumen Technologies nearly doubled for the second week in a row. They made a deal to supply next-generation fiber optic cable to Corning [GLW].

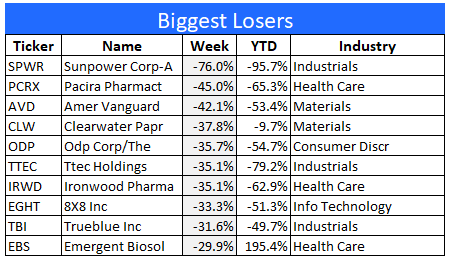

The 10 worst performing stocks from last week

Here are the 10 worst performing stocks in the S&P 1500 last week.

Sunpower Corp looks like it might not survive.

Final thoughts

Tuesday, July 16th was the last new high water mark we've seen. Will there be more new highs this year? I think the odds are overwhelming that we will. I stand by my forecast for a soft landing (no recession) and Fed rate cuts starting in September. We may see more selling in the next few weeks, but the long-term momentum of this market remains strong.

Investors are worried about the slow pace of earnings gains from the AI phenomenon, and they should be. But market participation continues to broaden out and there is less dependance on the Mag 7 to lead the way higher. If we do get another bout of selling, make sure your watchlist is up to date. And buy the dip.