In this weekly outlook, I examine the asset classes, sectors, equity groups, ETFs, and individual stocks that are leading the market higher, and which market segments are lagging behind.

By keeping an eye on the leaders and laggards, we can get a sense of where the big money is going, and where it's coming from. Signs that market participation is broadening out are continuing to show up in the data. As this trend continues, it is improving the durability of the rally.

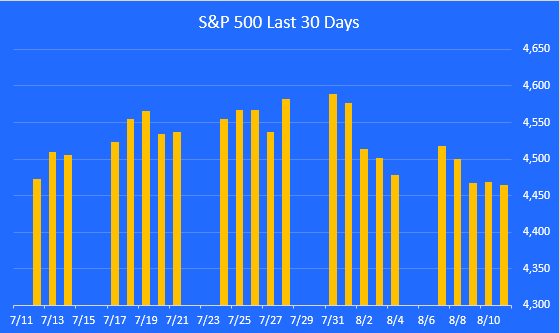

The S&P 500 rally takes a rest.

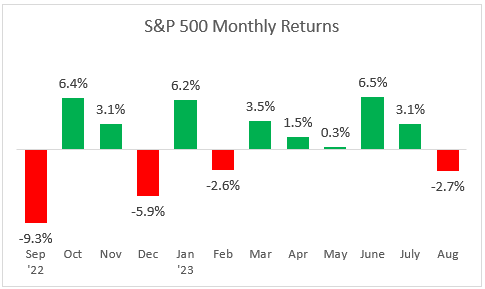

A look at monthly returns.

This chart shows the monthly returns for the past year. After gaining 3.1% in July, August is starting out in negative territory. The Fitch downgrade of US Treasury bonds set a negative tone for the market. A small uptick in inflation didn't help.

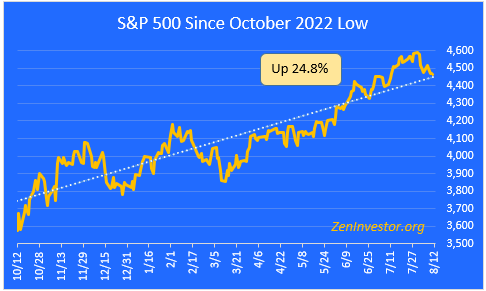

The bull market continues.

This chart highlights the 24.8% gain in the S&P 500 from the October 2022 low through Friday's close. The index is now just 6.9% below its record high close on January 3, 2022.

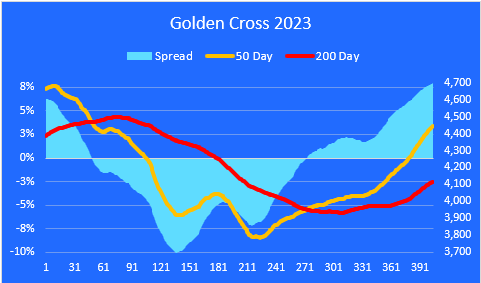

The Golden Cross.

The market entered a Death Cross configuration (a Death Cross occurs when the 50 day moving average crosses below the 200 day) on March 14, 2022. The Death Cross ended on February 2, 2023. We are now in a Golden Cross configuration, with the 50 day above the 200 day.

The spread between these two moving averages is widening. Today it stands at 7.9%, more than three times as wide as the long term average of 2.3%. This wide spread is one of the reasons I'm expecting a pullback of 5-7% for the S&P 500.

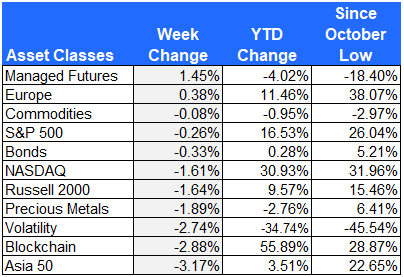

Major asset class performance.

Here is a look at the performance of the major asset classes, sorted by last week's returns. I also included the year-to-date returns as well as the returns since the October 12, 2022 low for additional context.

The best performer last week was Managed Futures, as investors looked for ways to protect their gains from further downside in the market. Managed Futures can quickly shift from long to short exposure as conditions warrant.

The worst performing asset class last week was Asia, which gave up 3.17%. This asset class is dominated by China equities, which have been struggling to keep up with the rest of the global markets.

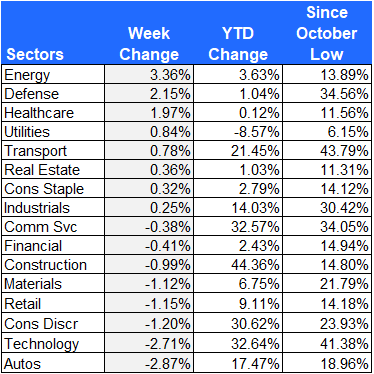

Equity sector performance

For this report I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. This gives us added granularity as we survey the winners and losers.

Energy stocks led the way higher last week thanks to a rebound in crude oil and natural gas prices. Defense contractors, Healthcare providers, and Utilities all bucked the trend by moving higher.

Autos and Technology were the hardest hit, losing almost 3% each for the week.

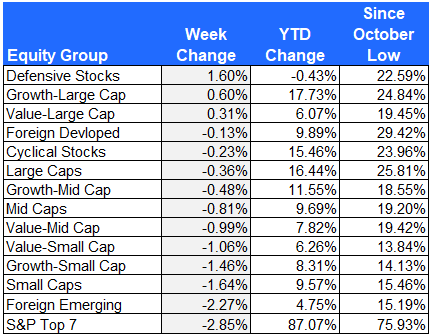

Equity group performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

Defensive stocks, which had been lagging behind, finally saw some buying interest as participation in the rally broadens out. Emerging Market stocks sold off, thanks in large part to the weakness in the China market.

The worst performing group, for the second week in a row, was the mega-cap S&P Top 7. Three weeks ago, this group was up by an average of 100% on a YTD basis. Since then, they have given back 13%.

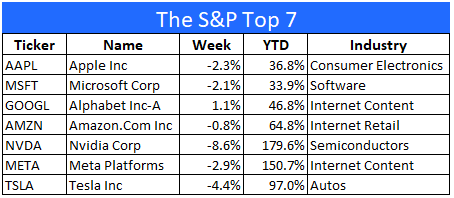

The S&P Top 7

Here is a look at the seven mega-cap stocks that have been leading the market all year. Nvidia gave back 8.6% as investors took profits and rotated into less expensive, more defensive names.

Google was the only winner among these 7 names. According to an article in Bloomberg, "San Francisco's Public Utilities Commission voted 3 to 1 to allow General Motors Co.’s Cruise LLC and Alphabet Inc.’s Waymo to increase the areas of the city where they can operate a car without a safety driver, and charge riders a fare for it."

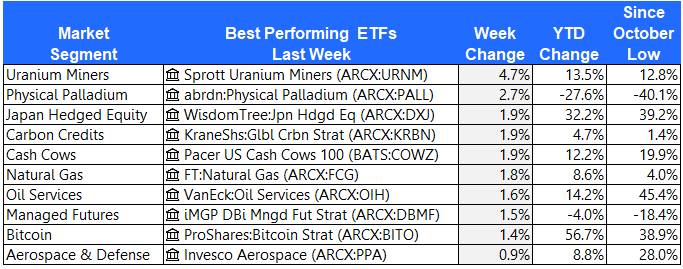

The 10 best performing ETFs from last week

The ETF leader board was dominated by physical commodity producers last week. Uranium and Palladium both had a good week. Energy also did well.

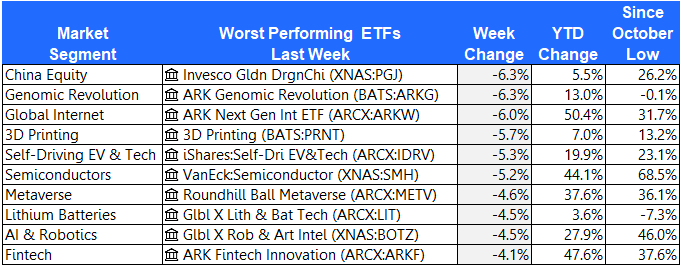

The 10 worst performing ETFs from last week

Last week's losers were dominated by technology-based ETFs.

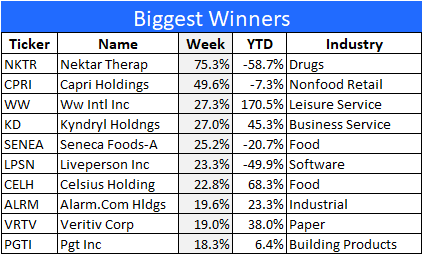

The 10 best performing stocks from last week

Here are the 10 best performing stocks in the S&P 1500 last week.

NKTR reported a narrower second quarter loss. CPRI beat their earnings number.

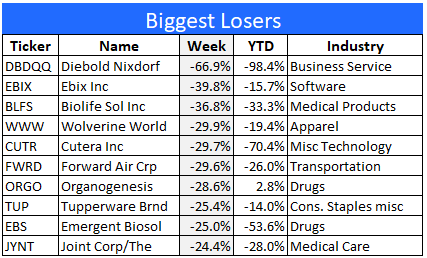

The 10 worst performing stocks from last week

Here are the 10 worst performing stocks in the S&P 1500 last week.

DBDQQ is now changing hands for 2 cents per share. Survival is far from assured.

EBIX plunged 40%. According to The Motley Fool, Ebix is "A provider of enterprise software solutions for the insurance and financial services industries. The pace of negative revenue growth has been accelerating. Ebix reported a 4% year-over-year decline in the fourth quarter of last year, expanding to a 15% decline in this year's first quarter."

Final thoughts

The S&P 500 was down 0.3% last week. The mega-cap tech stocks led the way lower. The good news is that market leadership and participation are continuing to broaden out. The fact that the market was only down by 0.3% while the mega-cap leaders were down 2.9% is very encouraging.

I have been expecting a pullback of 5-7%, which may have already begun. This would wring some of the froth out of the market and allow earnings to catch up with prices. As long as small caps, mid caps, and value stocks continue to outperform the S&P Top 7 mega-caps, I think a 5-7% pullback would improve the sustainability of this bull market.