In today's issue of the 1-Minute Market Report I point out two key items. Friday was an extremely rare 37:1 down day, and we closed below near-term support, which means that this selloff has further to go.

The good news is that big declines like this usually happen near the end of a bear market, when the last remaining dip-buyers become discouraged and head for the exits. I don't think the dip-buyers have given up yet, but their ranks are thinning as the rally-sellers continue to dominate the action.

Snapshot of last week

This chart from Jill Mislinski at AdvisorPerspectives tells the story. Investors began the week with concerns about what Fed Chair Powell might say on Friday. Those concerns were replaced by optimism that Powell might sound a little less hawkish.

Then Powell took the stage on Friday and made it clear that the Fed would keep raising rates until inflation was down to their 2% target, even if it caused some economic pain as a result. The market was not expecting that much hawkishness and quickly sold off.

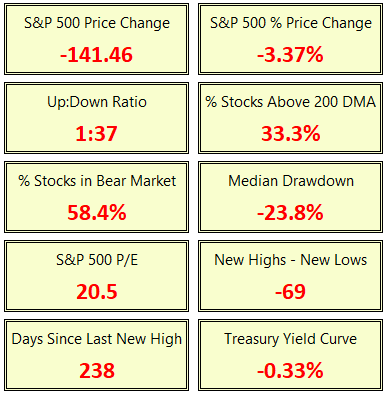

Friday's Stats

Friday's drop of 3.37% was the 88th worst day for the S&P 500 since 1950. Virtually all of the days that were worse than Friday, happened near the end of previous bear markets. The average gain over the next 6 months has been 10.4%.

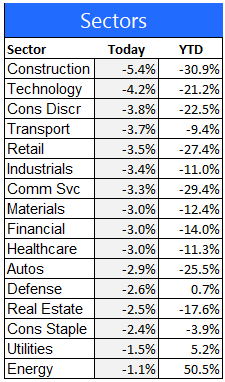

Equity sector performance

For this report I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. I find that using all 16 gives a fuller picture of which areas of the market are attracting the most buying and selling interest from investors.

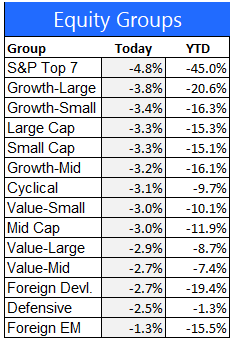

Equity group performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

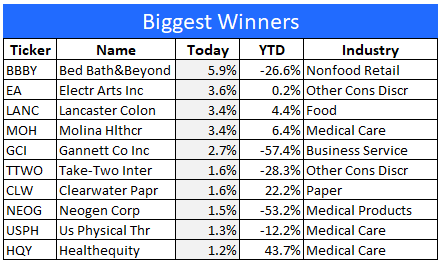

The 10 best performing stocks today

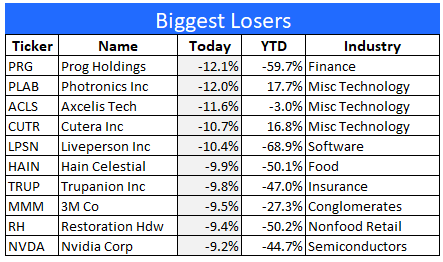

The 10 worst performing stocks today

Final thoughts

Friday August 26 was one of the ugliest days in the market that I’ve ever seen. Hands down, the ugliest day of all was October 19th, 1987. That was the day the market crashed 20%, fueled by massive computer-generated selling, which was an unintended consequence of the popular risk management tool called “portfolio insurance.” Each wave of selling begat another wave until the final bell sounded. At that time, there were no circuit breakers in place to halt the decline and give traders and investors time to gather their thoughts. It was virtually a straight line down with no perceptible bounces along the way.

The second worst day was March 16, 2020, as the pandemic came into focus and the economy began to shut down. The market fell 12% that day, and that was after it had already dropped by 9.5% a few days earlier. Circuit breakers allowed the 34% peak-to-trough pandemic decline to be spread across multiple weeks, with a few rally attempts in between.

Today’s 3.37% drubbing seems mild by comparison. Mild it wasn’t. For every stock that was up today, 37 were down. I don’t have the comparable numbers for the 1987 crash, but they couldn’t have been much worse than what we witnessed today.

Where do we go from here? Probably lower for a while, but history shows that big down days in the market usually happen near the end of a bear market. On average, the market is higher by 10.4% six months after a day like we had today. Even better, the market is higher by 20%, on average, 12 months later. There are exceptions, of course, but history favors the optimists who are looking ahead 6 to 12 months.