The 1-Minute Market Report is tailored for those who want a quick recap of what's going on, without the usual fluff and filler. I try to focus on the main drivers of the current market action, and offer some brief commentary along the way.

A quick summary

- The shortage of workers is worse than you might think.

- Inflation and omicron are weighing heavily on consumers and investors.

- The market valuation bubble is leaking but hasn't popped.

- The market is close to dipping below its 50-day moving average.

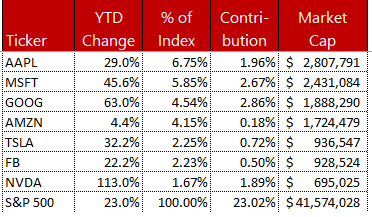

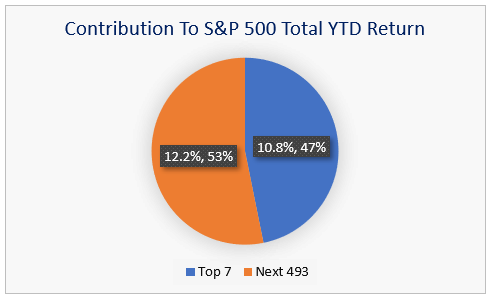

- Almost half of the 23% gain for the S&P 500 has come from just 7 stocks.

- Wall Street consensus is a gain of 5-10% for the S&P 500 next year.

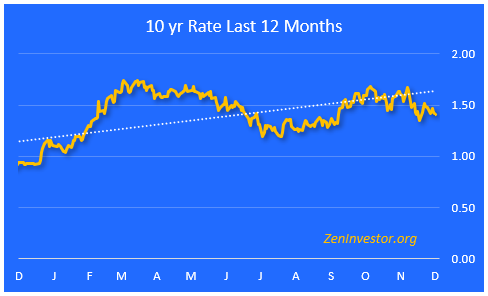

- The Treasury yield curve is flattening.

Where are the workers?

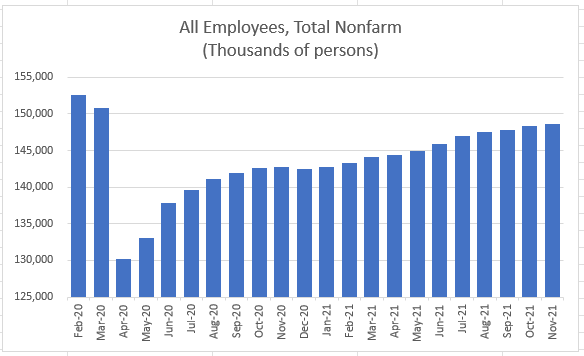

At first glance it looks like we're almost back to full employment, but we're not. We are still short 3.9 million employees, compared to the pre-Covid number. And we only added 210 thousand persons in November.

How long will it take to hire 3.9 million workers?

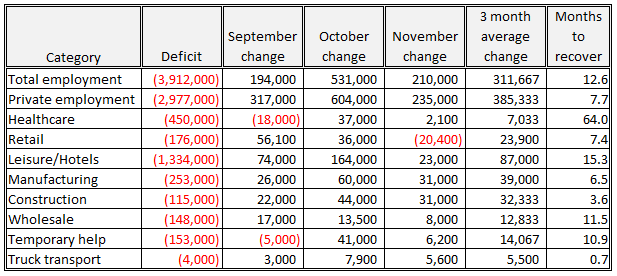

The table below shows the worker deficits for each of the sectors with the largest share of total employment. The last column shows how long it will take for each sector to return to full employment, based on the trend in hiring over the last three months.

Omicron and inflation

I think Omicron will be handled because we're better prepared this time. But inflation looks sticky and the Fed is now signaling their intent to raise rates sooner than they had previously said.

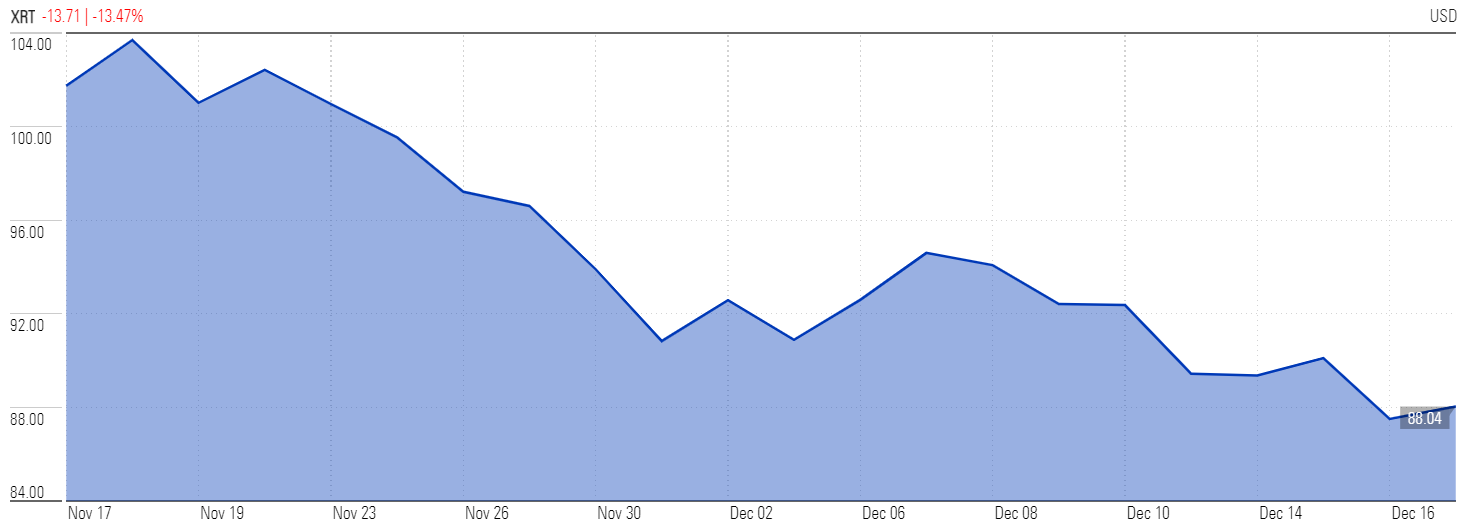

Retail sales have already peaked, and the retail sector ETF (XRT) has been in a downtrend for the last month.

SPDR® S&P Retail ETF XRT

Almost half of the 23% gain for the S&P 500 has come from these 7 stocks.

Here's what this narrow leadership looks like in a pie chart.

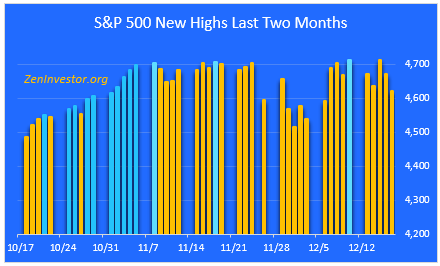

The new high count has stopped, at least temporarily. We have 67 new highs so far, second only to the 77 from 1995.

The blue bars in this chart are new highs. We've only had three of them over the past 6 weeks. I expect that we'll see a few more before the end of the month.

The Treasury yield curve is flattening.

As stock investors seek safety in the Treasury bond market, the rates have fallen, putting the squeeze on the yield curve. When the Fed starts to increase the Fed Funds rate, the curve will flatten even faster.

Final Thoughts

I'm keeping an eye on the S&P Top 7 as the canary in the coal mine. If these stocks continue to weaken, it could be signaling a change in market trend. I'm also watching for a decline in the S&P 500 of close to 5%, followed by a rally that stalls out just short of making a new high.

If the market then breaks 7% on the downside, it could mean that the dip-buyers have lost confidence. And without them, the sheer weight of high valuations and massive debt could bring a more long lasting selloff.