Defending the 10% correction line.

The 1-Minute Market Report is tailored for those who want a quick recap of what's going on, without the usual fluff and filler. I try to focus on the main drivers of the current market action, and offer some brief commentary along the way.

A quick summary

- The S&P 500 is down 7.9% from the January 3 high.

- The S&P 500 fell -1.8% last week, and we're still not out of the woods.

- The dip-buyers must defend the -10% correction line or risk losing control.

- We are in a rolling bear market, with 43% of all stocks down 20% or more.

- A hawkish Fed, surging inflation, omicron, and now a potential shooting war with Russia are formidable headwinds.

- There are pockets of resistance amongst the broader carnage .

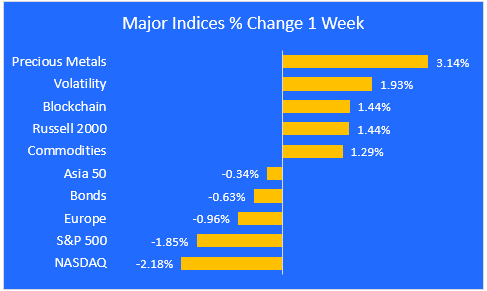

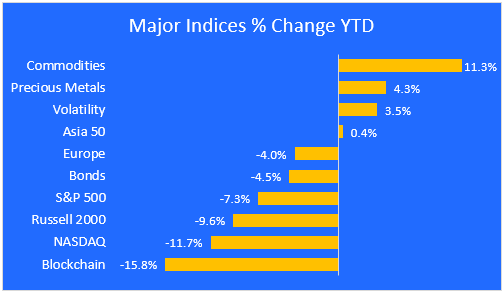

Charts 1 & 2. Major Indices

For the week just past, precious metals caught a bid as Russia-Ukraine tensions continued to escalate. Volatility was up as the market fell hard Thursday and Friday.

Hardest hit last week was the tech-heavy NASDAQ, as investors continue to rotate away from growth and towards value. The small-cap Russell 2000 finally had a long-overdue bounce.

On a year-to-date basis, commodities, precious metals, and volatility lead the pack.

Companies that have embraced cryptocurrencies are taking a hit, as is the tech-heavy NASDAQ. The small-cap Russell 2000 had a bounce last week but it still remains depressed on a year-to-date basis.

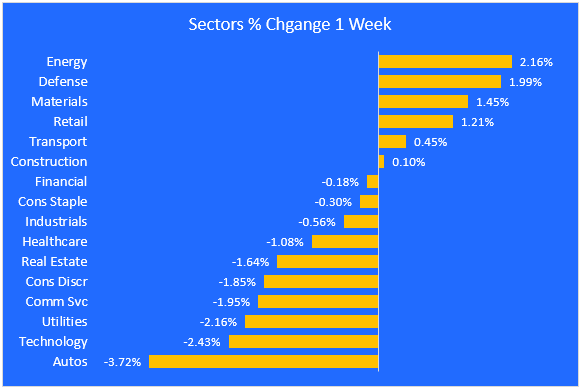

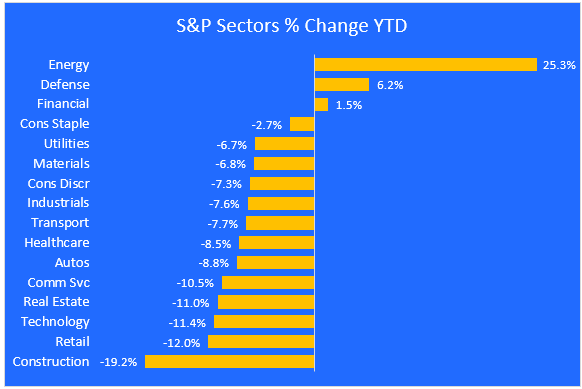

Charts 3 & 4. S&P 500 Sectors

Energy has continued its strong performance from last year, gaining 2.2% last week and 25.3% YTD. Defense stocks like Lockheed and General Dynamics are getting a boost from the threat of a new shooting war.

Financials held up relatively well last week as the 10yr Treasury bond briefly broke above 2%. Rising rates allow banks to charge more for loans. Their commercial lending activity is benefitting from an increase in capital expenditures for supply chain improvements.

Construction and retail both had a good week but remain in the basement YTD, thanks to fears of a Fed-induced recession and a temporary slowdown in shopping due to the omicron surge.

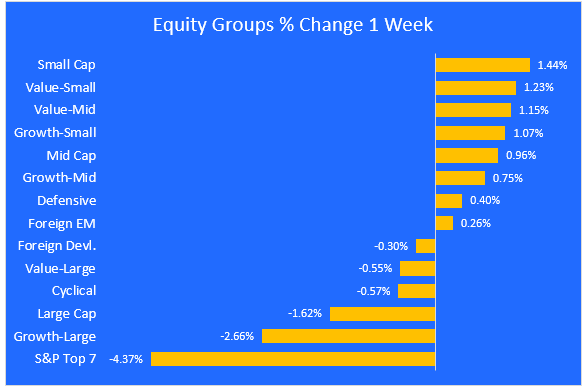

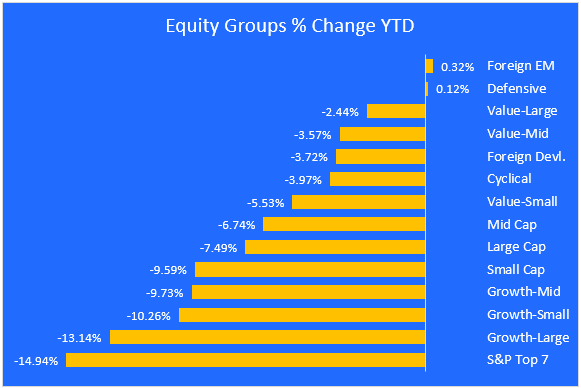

Chart 5 & 6. Equity Groups

These two charts show the performance of stocks that share certain characteristics, like value vs. growth, large vs. small cap, and cyclical vs, defensive. I created these groups to offer a way of visualizing the flow of investor money - where it's going and where it's coming from.

Following the money removes much of the subjectivity embedded in forecasting what may happen in the future. I want to see what's happening now. and whether a trend is being established.

The most noteworthy trend is how far Big Tech has fallen, including last week as well as year-to-date, after leading the market last year. Investors continue to rotate out of growth and into value, and they are gravitating towards non-US markets.

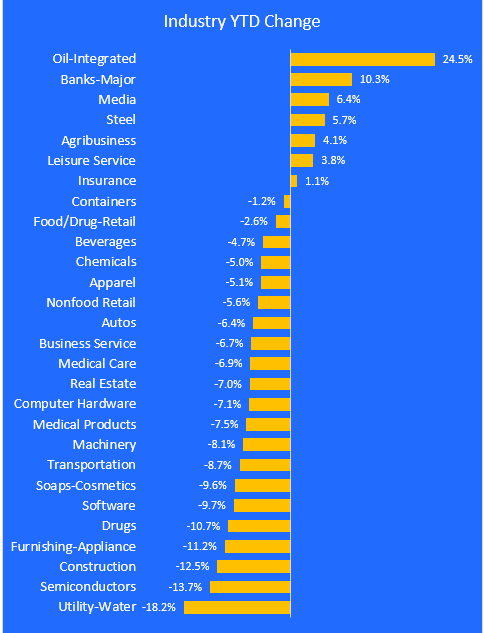

Chart 7. Industries

Zacks Investment Research tracks 60 different industry groups, and that is where the next chart comes from. Here are the largest 28. It's no surprise that Big Oil is the leader by a wide margin. Water utilities are in last place for reasons that escape me. Perhaps someone can share their insights in the comments below.

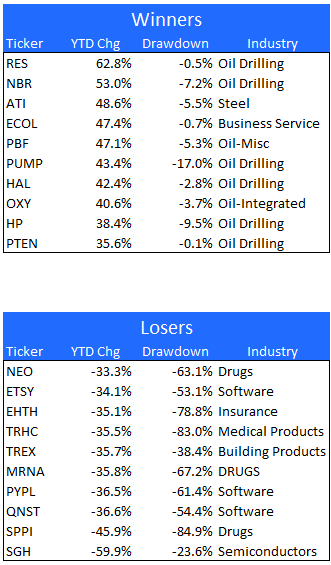

Charts 8 & 9. Stock winners & Losers YTD

The final two charts drill down into the specific stocks that have gained and lost the most year-to-date. 8 of the 10 top performers are involved in the oil business. This looks like a durable trend, and not just an oversold bounce or a reaction to the Russia-Ukraine tensions.

Producers of steel and other commodities are also doing well this year.

Of the ten biggest losers YTD, 4 are from the healthcare sector and 4 are from the tech sector. Semiconductor manufacturers are especially hurting due to their high starting valuations, and because you can't sell what you don't have.

Final Thoughts

After taking back-to-back hits on Thursday and Friday, the the dip-buyers once again failed to hold the 5% marker. They must now make a stand to defend the 10% correction line. They succeeded this week, but will they hold the line the next week? The aggressive rally-sellers will surely test them.

If they remain true to form, the dip-buyers will eventually take the market to a new high, but I don't think we've seen the bottom yet. I'm betting that the 10% level will be breached, and they will have to start the march to a new high from a lower low.

The great rotation out of tech and into energy and other commodities continues, and will probably keep going for the first half of the year, if not longer. And the rise of value over growth should remain intact. The same is true for foreign vs. domestic markets.

Regarding tech, I think the best growth will be in AI, robotics, and cybersecurity. These companies are under the same price pressure that the big tech names are experiencing, but once they stabilize I think they will become the new leaders in the tech space.