In this week's issue of the 1-Minute Market Report I examine the asset classes, sectors, equity groups, and ETFs that led the market higher, and which market segments bucked the trend by moving lower.

By keeping an eye on the leaders and laggards, we can get a sense of where the big money is going, and where it's coming from. Signs that market participation is broadening out are continuing to show up in the data. If this trend continues, it will improve the durability of the rally. Details to follow.

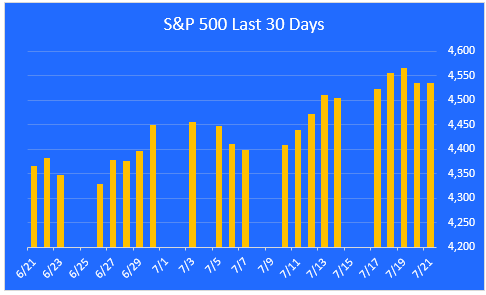

The S&P 500 rally continues.

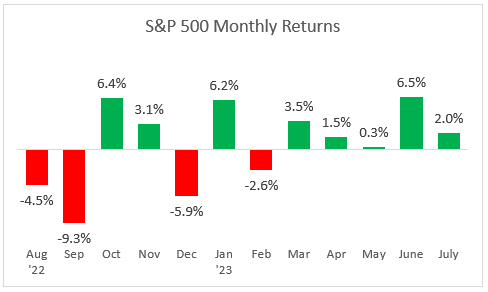

A look at monthly returns.

This chart shows the monthly returns for the past year. After a brief pullback in the first week, July is now back in positive territory. Good news on the inflation front has bolstered the case for an end to the Fed's rate hiking cycle.

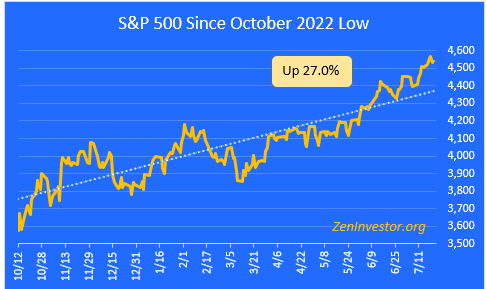

The bull market continues.

This chart highlights the 27.0% gain in the S&P 500 from the October 2022 low through Friday's close. The index is now just 5.4% below its record high close on January 3, 2022.

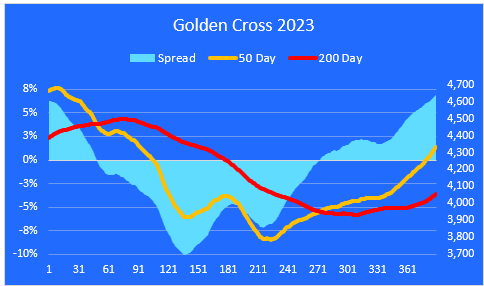

The Golden Cross.

The market entered a Death Cross configuration (a Death Cross occurs when the 50 day moving average crosses below the 200 day) on March 14, 2022. The Death Cross ended on February 2, 2023. We are now in a Golden Cross configuration, with the 50 day above the 200 day.

The spread between these two moving averages is widening. Today it stands at 6.9%, three times as wide as the long term average of 2.3%. This wide spread is one of the reasons I'm expecting a pullback of 5-7% for the S&P 500.

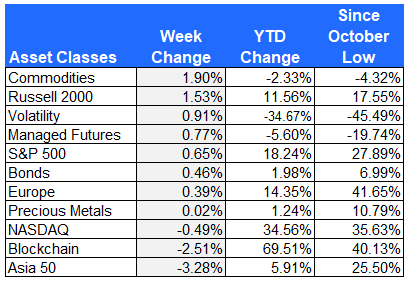

Major asset class performance.

Here is a look at the performance of the major asset classes, sorted by last week's returns. I also included the year-to-date returns as well as the returns since the October 12, 2022 low for additional context.

The best performer last week was Commodities, which finally caught a bid after a year-long slide. Oil, gas, and agriculture contributed to the gains.

The worst performing asset class last week was Asia, led lower by China. At the start of 2023, economists were expecting a pickup in China's economy as Covid restrictions began to ease. But the data so far has been disappointing.

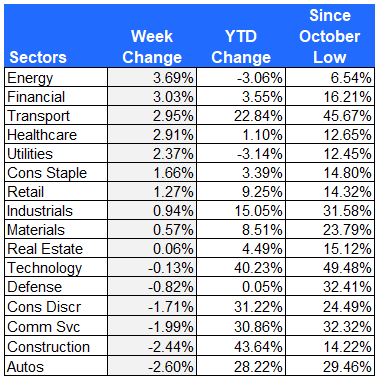

Equity sector performance

For this report I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. This gives us added granularity as we survey the winners and losers.

Energy stocks led the way higher last week but are still in the red on a year-to-date basis. Utilities are also in the red YTD.

Autos and home construction gave back some of their gains last week but they are still ahead of the S&P 500 YTD.

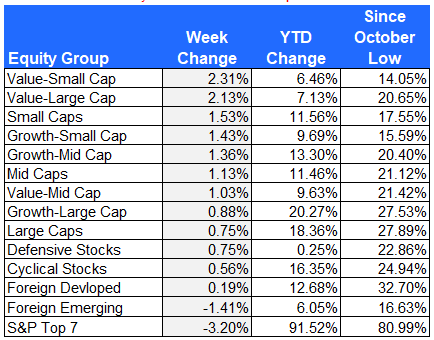

Equity group performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

In a healthy sign for the market, small and mid caps continue to make up ground vs. large caps. Value outperformed growth.

There are signs that Big Tech, the driver of this year’s rally, may be losing some of their momentum. The S&P Top 7 was the worst performing equity group last week. The fact that the market still managed to gain ground without the help of Big Tech is very encouraging.

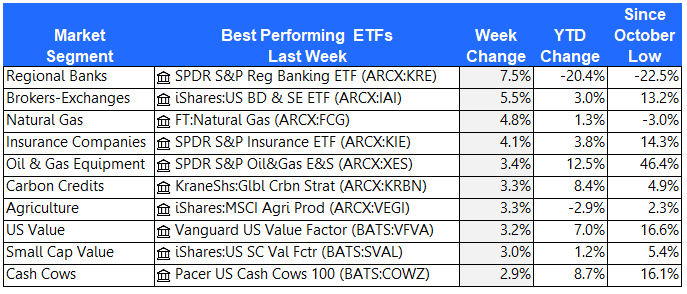

The 10 best performing ETFs from last week

Financials and Energy led the ETF pack last week.

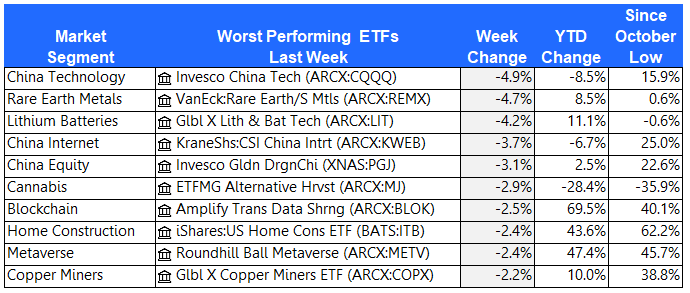

The 10 worst performing ETFs from last week

Three of the ten worst performing ETFs were tied to the weak China stock market.

Final thoughts

The market made another new high for 2023 on Wednesday. What is most impressive to me is the fact that the market ended the week with a gain, despite the poor performance of Big Tech. Nicholas Colas from Data Trek Research had this to say in this week's Barron's:

With the S&P 500 up so much this year, some investors may opt to take profits and sit out the rest of 2023. Others might just rotate out of highflying tech names into cyclicals, such as financials. That might make for a good trade, and a rotation is typically a bullish signal.

But because tech is such an outsized portion of the market, those other stocks would have to post enormous gains to move the index meaningfully in the back half of the year. “If Big Tech goes down by 10%, you need everything else to go up so much more,” Colas said.