The market is making new all-time highs. Is this the final “Melt-Up” I’ve been anticipating?

Or is it something more sustainable?

Bull Case versus Bear Case

The bulls have once again taken control of the direction of the market. Three new highs last week. We have to respect the determination of the bulls today. The way I see it is that the bulls are still anticipating a series of rate cuts by the Fed. They may also be anticipating a grand bargain on trade with China.

The bears, meanwhile, are sitting there with their tails tucked behind them, not knowing what to do next. If you’ve been reading these missives for a while, you know that I’m a 65% bull and a 35% bear. I have been thus for several months.

Mean Reversion

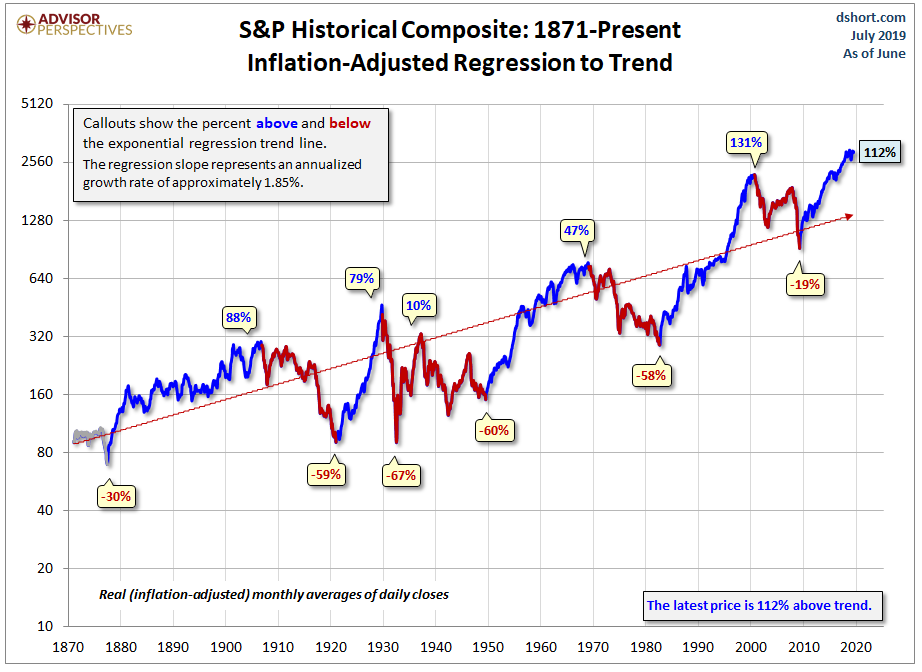

This chart comes from Jill Mislinsky and Doug Short. It shows clearly that today’s market is very overvalued from an historical perspective. It might get even more overvalued, but eventually it will revert to the mean, as it has always done before.

See the 1-minute market report from May 31 here.

Final Thoughts

The stock market is on the verge of melting up, which is just what the bullish camp has been waiting for. There is a lot of optimism about a grand deal between US and China on trade policy.

There is also widespread assumption that the Fed is about to cut rates. If they do, it won’t be to cool off an overheated economy. It will be to rescue the economy from the next, inevitable, recession. Therefore, I think it would be wise for investors to take some profits on this melt up. I don’t mean sell everything. Just lighten up a bit on equity exposure.