In this brief market report, we look at the various asset classes, sectors, equity categories, ETFs, and stocks that moved the market higher and the market segments that defied the trend by moving lower.

Identifying the pockets of strength and weakness allows us to see the direction of significant money flows and their origin.

The tariff tantrum continues.

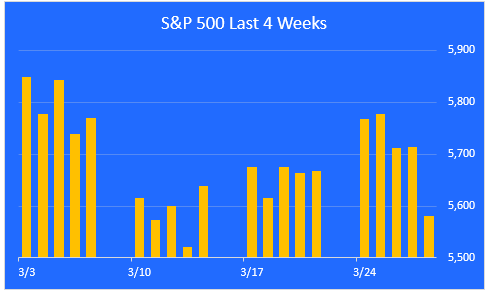

In addition to tariff war worries, weakness in Consumer Spending and Earnings Estimates drove the market lower. Investors continued to pull back from equities and seek safety in Cash, Gold and Treasury bonds. The market was down 1.5% for the week and down 5.1% YTD. Friday's selloff was particularly harsh.

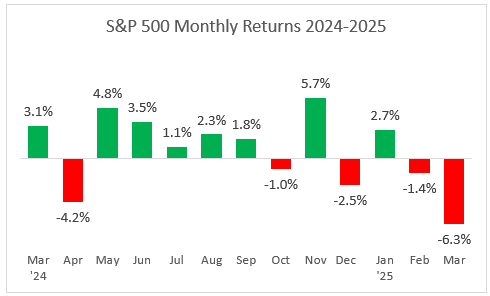

A look at monthly returns.

This chart shows the monthly returns for the past year. With one day left to go, March is set to be the worst month for equity investors in the past 12 months..

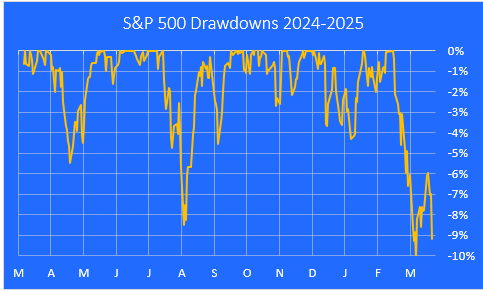

A look at drawdowns this year.

Here is a closer look at the pullbacks we've had over the last 12 months, using a drawdown chart. The current drawdown is -9.2% from the February 19 high.

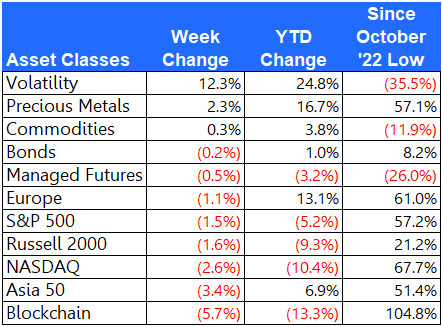

A look at the bull run since it began last October.

This chart highlights the 56% gain in the S&P 500 from the October 2022 low through Friday's close. We are well below the trendline and it looks like we may have further to go on the downside before this correction is over.

Major asset class performance.

Here is a look at the performance of the major asset classes, sorted by last week's returns. I also included the returns since the October 12, 2022 low for additional context.

The best performer last week was Volatility, reflecting Friday's big market drop. The worst performer was Blockchain, as Bitcoin and other cryptos saw heavy selling.

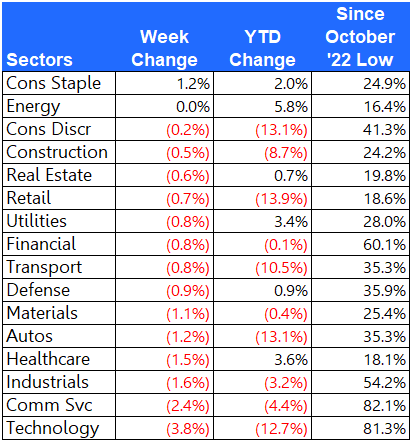

Equity sector performance

For this report I use the expanded sectors as published by Zacks. They use 16 sectors rather than the standard 11. This gives us added granularity as we survey the winners and losers.

Investors were buying defensive sectors like Consumer Staples while selling Tech and Comm Services.

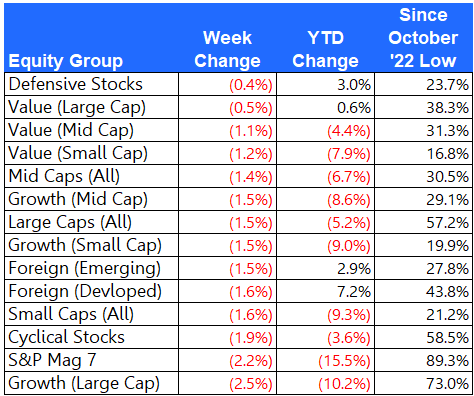

Equity group performance

For the groups, I separate the stocks in the S&P 1500 Composite Index by shared characteristics like growth, value, size, cyclical, defensive, and domestic vs. foreign.

The best performing groups were Defensive plays and Large Cap Value. Investors raised cash by selling the Mag 7 and other Growth stocks.

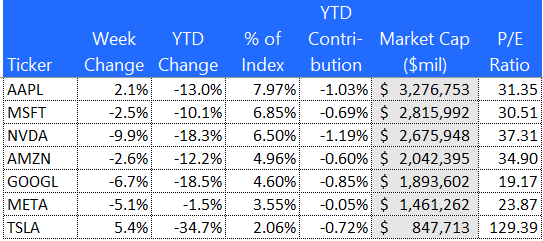

The S&P Mag 7

Here is a look at the seven mega-cap stocks that had been leading the market over the past two years. These seven stocks are off to a weak start YTD. Faith in the AI trade is being tested. Participation in the bull market has broadened on a YTD basis. Nvidia (NVDA) was hardest hit while Tesla (TSLA) rallied after taking quite a beating over the past few weeks.

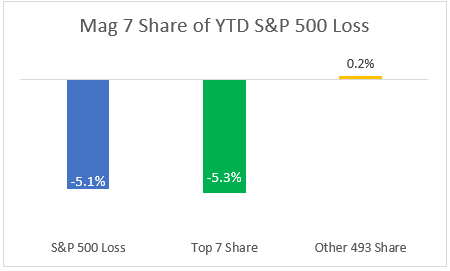

The Mag 7 dominance is a drag on performance.

After leading the market higher for the last two years, the Mag 7 are now a drag on the S&P 500 index on a year-to-date basis. The other 493 stocks in the S&P 500 are up an average of 0.2% YTD.

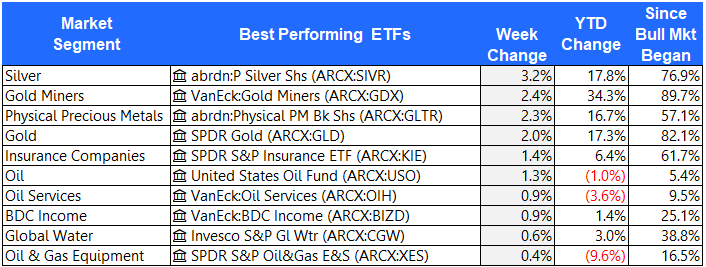

The 10 best performing ETFs from last week

The two biggest winners this week - Silver and Gold Miners - demonstrate how market leadership is changing in 2025. Investors are shunning growth stocks and seeking shelter in defensive names, cash, bonds, and precious metals.

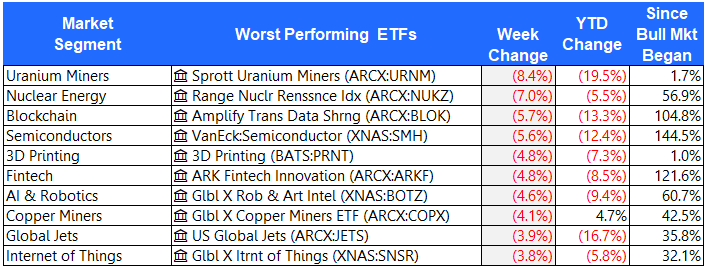

The 10 worst performing ETFs from last week

Uranium miners have been in a downtrend since June 2024. Nuclear Energy was a hot industry until January 2025. Since then, it has hit the skids.

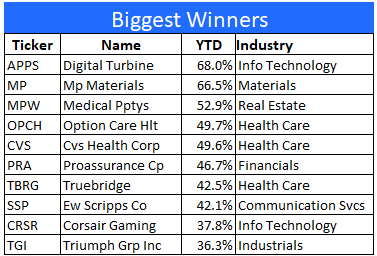

Best Performing Stocks

Watch out for Digital Turbine (APPS). It's a penny stock, and it doesn't take much effort to move the price by a large amount. MP Materials (MP) was the #1 stock last week and #2 this week.

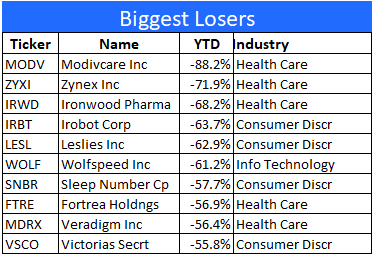

Worst Performing Stocks

Modivcare (MODV) is now changing hands at $1.39 per share. In 2021, investors were paying $210 per share.

Final thoughts

To recap, in the week just past, investors were:

- Selling Bitcoin and buying Gold

- Selling stocks and buying volatility (VIX)

- Selling Tech and buying Staples

- Selling Growth and buying Value

- Selling Cyclicals and buying Defensive names

- Selling the Mag 7 (except for TSLA) and building cash positions