A quick summary

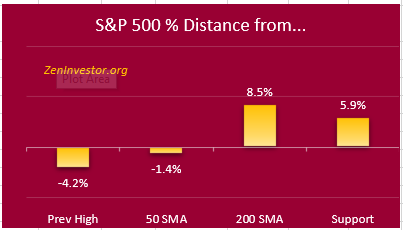

- The market is only down 4.2% from its Feb 12 high.

- This is no time to panic, but raising a little cash is prudent.

- Pundits are blaming the drop on sharply rising interest rates.

- Will the Dip-Buyers step in once again to bring us to new highs?

The S&P 500 is only down 4.2% from its most recent high.

We're in a rough patch for sure, but let's put in perspective. A drawdown of 4.2% is a mild pullback, not even close to a 10% correction. We broke below the 50 day moving average, but we're still comfortably above the 200 day. We're also 5.9% above support (3714).

Volatility is rising.

The long-term average for volatility, as measured by the VIX index, is around 13. Today it's more than twice as high. You can't read too much into the VIX numbers but clearly investors are becoming more anxious.

Final Thoughts

The market has logged 5 down days out of the last 6. But I believe that the Dip-Buyers will once again step in to put a floor under the market and push prices to new highs. They have been doing this since the last bear market bottom on March 23, 2020.

The proximate cause of this market slide was the spike in the 10 yr Treasury bond. This can signal coming inflation or a change in Fed policy on short term rates. Chairman Powell has said repeatedly that he will continue to keep short term rates near zero until the economy shows durable signs of improvement.

We might be getting close to this, given the rollout of Covid vaccinations and reopening of many businesses and institutions. So, why the market is declining when the fundamentals of the economy are improving?

It might just be a case of "buy on the rumor and sell on the news." The market has been anticipating better earnings, more re-openings, wide availability of Covid vaccines, and a new round of stimulus checks that will spur consumer spending.

Valuations are still high, and there is a rotation going on. High-flying tech giants are being sold, while boring cyclical and value names are the new darlings of today's investor.

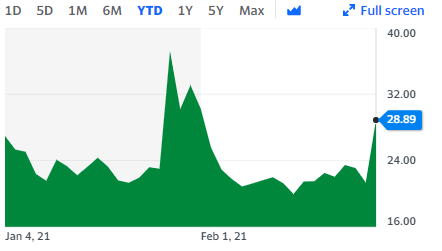

This is a stock-pickers market. There will be big winners and big losers. As an example, consider Tesla (TSLA). It's down 29%, even after announcing it was embracing Bitcoin. FNMA is down 34%.

On the upside, Salem Media (SALM) is up 105%. Teradata (TDC) is up 20%. This is why I say that this is a stock-picker's market.

My Triple Cross Moving Average indicator is saying that caution is warranted and equity exposure should be reduced incrementally.

Thanks Eric,

This is great information. Thank you for taking the time to chat with me yesterday as well. Once I am well enough I will send you my portfolio and possibly book another time to chat. I am considering your offer. Many thanks. Sandy

My portfolio is down 7% from its high 2 weeks ago but up 30% from Dec 1 2020, your ZEN 10 (which I made a Yahoo portfolio of) I note is still up almost 12% for the year. I wonder if you read Avi Gilbert at all or if you have any thoughts on Elliot Wave? I do and so have been expecting something of a drop perhaps to over 10%. As a small investor who is not full time "watching the tape" I have not sold off anything and expect the "high flyers" in the portfolio, where most of the damage has been to recover as quickly as they fell. I do appreciate your thoughts.

I’ve read Avi and Elliot Wave, and have not been impressed. Too many moving parts for my taste.