Investors are optimistic about the new Biden administration

Investors in the U.S. stock market (foreign and domestic, retail and institutional) are generally non-partisan, especially wealthy investors who control the bulk of money that flows through the market. They may have partisan views, but when it comes to their wealth they only care about the way policy and politics will impact the economy and corporate earnings.

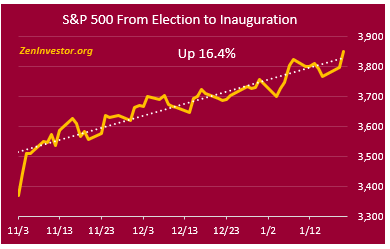

Trump was in office as the stock market gained an average of 14.4% per year from the day he was elected to the day Biden was elected. An above average return to be sure. but it’s worth noting that in spite of Mr. Trump’s warning that if Biden won the 2020 election, the stock market would crash. Instead, the market has gained 16.4% since Biden was elected. What’s causing this?

One explanation is that investors believe that Biden will send more stimulus money to people who sorely need it. This money, if it arrives, will probably be spent quickly, which will boost retail sales and keep people who are facing eviction or homelessness in their homes. It remains to be seen whether this added stimulus will come to pass.

Another explanation is that the Biden Fed will keep rates low for longer, and continue buying bonds indefinitely. This seems likely, but at some point there come an end to this Fed largess, especially when inflation rises above their target rate.

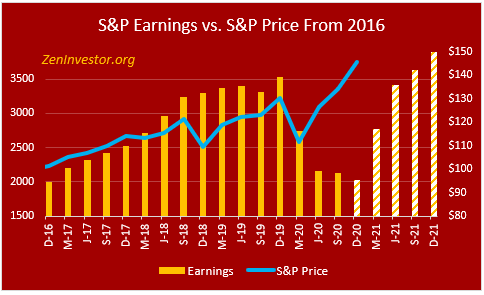

Investors are betting that earnings will return to normal by the 3rd Quarter of 2021

Take a good look at the above chart. The market bottomed in March of 2020, with the expectation that this pandemic and its impact on earnings would be short-lived. They might turn out to be right about that. But it takes a monumental leap of faith to buy stocks now when the market is so overvalued.

In his classic book “Stocks For The Long Run” Jeremy Siegel noted that the stock market anticipates a recovery from recession an average of 4 months in advance. Today’s investors are looking ahead 18 months. They are looking over a deep chasm of punk earnings, a still rising pandemic, and a Congress that doesn’t appear to be willing to work together to solve problems.

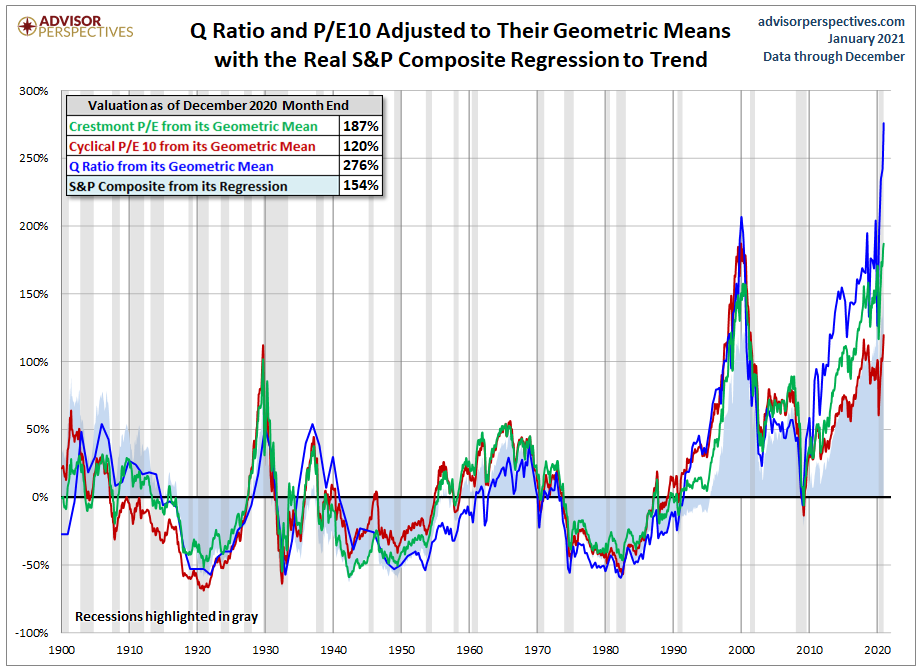

The U.S. stock market is now in a valuation bubble

As the above chart from Jill Mislinski shows, we are now in a stock market bubble. We could be in the early stages or the late stages, but it’s a valuation bubble nonetheless.

The Implication: Bubble Markets eventually pop

1. The Dutch Tulip Bubble

The Tulipmania that gripped Holland in the 1630s is one of the earliest recorded instances of an irrational asset bubble. During the Dutch Tulip Bubble, tulip prices soared twentyfold between November 1636 and February 1637 before plunging 99% by May 1637, according to former UCLA economics professor Earl A. Thompson. (Investopedia)

2. The South Sea Bubble

The South Sea Bubble of 1720 was created by a more complex set of circumstances than Tulipmania. The South Sea Company was formed in 1711 and was promised a monopoly by the British government on all trade with the Spanish colonies of South America. Expecting a repeat of the success of the East India Company, which provided England a flourishing trade with India, investors snapped up shares of the South Sea Company.

As its directors circulated tall tales of unimaginable riches in the South Seas (present-day South America), shares of the company surged more than eightfold in 1720, from £128 in January to £1050 in June, before collapsing in subsequent months and causing a severe economic crisis. (Investopedia)

3. Japan’s Real Estate and Stock Market Bubble

In the present day, asset bubbles sometimes are fuelled by overly stimulative monetary policy. Japan’s economic bubble of the 1980s is a classic example. The yen’s 50% surge in the early 1980s triggered a Japanese recession in 1986, and to counter it, the government ushered in a program of monetary and fiscal stimulus.5

These measures worked so well that they fostered unbridled speculation, resulting in Japanese stocks and urban land values tripling between 1985 and 1989.6 At the peak of the real estate bubble in 1989, the value of the Imperial Palace grounds in Tokyo was greater than that of real estate in the entire state of California.7 The bubble burst in 1991, setting the stage for Japan’s subsequent years of price deflation and stagnant economic growth known as the Lost Decade. (Investopedia)

4. The Dotcom Bubble

When it comes to sheer scale and size, few bubbles match the dotcom bubble of the 1990s. At that time, the increasing popularity of the Internet triggered a massive wave of speculation in “new economy” businesses. As a result, hundreds of dotcom companies achieved multi-billion dollar valuations as soon as they went public.

The NASDAQ Composite Index, home to most of these technology/dot-com company stocks, soared from a level of under 500 at the beginning of 1990 to a peak of over 5,000 in March 2000.8 The index crashed shortly thereafter, plunging nearly 80% by October 2002 and triggering a U.S. recession.9 The next time the Index reached a new high was in 2015, more than 15 years after its previous peak. (Investopedia)

5. The U.S. Housing Bubble

Some experts believe that the bursting of the NASDAQ dot-com bubble led U.S. investors to pile into real estate due to the mistaken belief that real estate is a safer asset class. While U.S. house prices nearly doubled from 1996 to 2006, two-thirds of that increase occurred from 2002 to 2006, according to a report from the U.S. Bureau of Labor Statistics.11 Even as house prices were increasing at a record pace, there were mounting signs of an unsustainable frenzy—rampant mortgage fraud, condo “flipping,” houses being bought by sub-prime borrowers, etc.

U.S. housing prices peaked in 2006, and then commenced a slide that resulted in the average U.S. house losing one-third of its value by 2009.2 The U.S. housing boom and bust, and the ripple effects it had on mortgage-backed securities, resulted in a global economic contraction that was the biggest since the 1930s Depression.12 This period of the late 2000s thus came to be known as the Great Recession. (Investopedia)

Here’s a list of major companies to have filed for bankruptcy so far since the start of coronavirus.

Dean & Deluca

The New York City-based gourmet foods retailer filed for bankruptcy on March 31, one of the first businesses to show signs of trouble due to coronavirus impact. The company was founded in 1977 and was acquired by Pace Food Retail in 2014.

Apex Parks

Apex Parks, which owns and operates 14 family entertainment and water parks in New Jersey, California, and Florida, filed for Chapter 11 bankruptcy on April 8. A release from the company indicated that they do not intend to close.

FoodFirst, Bravo and Brio Restaurant Parent

FoodFirst Global Holdings, the parent company of restaurant chains Bravo Cucina Italiano and Brio Tuscan Grille, filed for Chapter 11 bankruptcy on April 10. FoodFirst acquired the brands in 2018.

True Religion Apparel

True Religion, a clothing brand known for its jeans, filed for Chapter 11 bankruptcy on April 13. The company, whose trendy denim rose to popularity in the 2000s, also filed for bankruptcy in 2017.

CMX Cinemas

CMX Cinemas, a chain of movie theaters with dine-in options, filed for Chapter 11 bankruptcy on April 25. The theaters, owned by parent company Cinemex Holdings, was in the process of acquiring the Star Cinema Grill, a deal that was inked only six weeks prior.

Rubie’s Costume Company

Rubie’s, which manufactures costumes, wigs, and other festive gear, filed for Chapter 11 bankruptcy on April 30. Rubie’s claims to be the world’s largest designer and manufacturer of Halloween costumes.

J. Crew

The preppy retailer worn by celebrities and shoppers alike filed for bankruptcy on May 4. The company also owns Madewell, a women’s clothing and accessory brand.

Gold’s Gym

Gold’s Gym, which owns and operates over 700 gyms in the U.S. and internationally, filed for Chapter 11 bankruptcy on May 4. The company said in a release they hope to be through the filing by Aug. 1, “if not sooner.”

Neiman Marcus

Luxury department store Neiman Marcus filed for Chapter 11 bankruptcy on May 7. The century-old retailer is one of several traditional department stores that could be headed for trouble.

Stage Stores, (Bealls, Goody’s, Palais Royal, Peebles, Gordman’s, and Stage Parent)

Stage Stores, which owns and operates almost 800 locations in smaller and more rural communities, filed for Chapter 11 bankruptcy on May 10. The brands sell a variety of goods, including apparel, cosmetics, and home goods.

JCPenney

Based in Plano, Texas, the retailer was founded more than a century ago as one of the country’s first department stores. But it has been on a downturn as people turn to online retailers and fast fashion to shop. JCPenney has faced financial trouble for several years, and filed for Chapter 11 on May 15. The retailer said it will announce the first phase of store closures in the coming weeks.

Pier 1 Imports

Home goods retailer Pier 1 Imports, which filed for Chapter 11 bankruptcy in February, announced May 19 that it is seeking bankruptcy court approval and plans to start a wind-down of business as soon as possible. The company was unable to find a buyer due to coronavirus impact. Pier 1 operates more than 900 stores nationwide.

Hertz

The Hertz Corporation, known for its car rental services, filed for Chapter 11 bankruptcy on May 22. Hertz, which owns other brands including Dollar and Thrifty, underwent a CEO change last week, its fourth in six years.

Tuesday Morning

Discount homewares retailer Tuesday Morning filed for Chapter 11 bankruptcy on May 27. The Texas-based company operates almost 700 stores in 39 states.

Le Pain Quotidien

French-inspired bakery and café chain Le Pain Quotidien filed for Chapter 11 bankruptcy on May 27. The company’s U.S.-based unit, PQ New York, is selling its locations to Aurify Brands, which owns fast casual chains The Little Beet and Five Guys Burgers, among others.

24 Hour Fitness

24 Hour Fitness, a chain of gyms, filed for Chapter 11 bankruptcy on June 14. The company is planning to reopen many of its locations during the coronavirus reopening, but 133 locations will permanently close as part of the restructuring.

GNC

Record-breaking holiday returns expected as consumers remain wary of exchanging gifts in-store

CEC Entertainment

CEC Entertainment, the parent company of kid-friendly Chuck E. Cheese restaurants, filed for Chapter 11 bankruptcy on June 24. The Texas-based company operates over 700 Chuck E. Cheese and Peter Piper’s Pizza locations, which offer dining and entertainment options for families.

Cirque du Soleil

Cirque du Soleil, the Canadian-based acrobatics and entertainment group, filed for Chapter 15 bankruptcy on June 29. The company said via press release that their financial restructuring is due to pandemic-related cancellations and closures. The company also announced layoffs for almost 3,500 of its already furloughed employees.

Lucky Brand

Denim and apparel retailer Lucky Brand filed for Chapter 11 bankruptcy on July 3. The company, founded in 1993, has been acquired by SPARC Group, which owns retailers such as Aeropostale and Nautica. In a press release, interim CEO Matthew A. Kaness cited COVID-19’s impact on business as a contributing factor to the filing.

Brooks Brothers

Classic suiting brand Brooks Brothers filed for Chapter 11 bankruptcy on July 8. The centuries-old retailer has been considering a potential sale for the past year, but, according to a company spokesperson, the pandemic “became immensely disruptive.”

Sur La Table

Sur La Table, the French-inspired cookware retailer, filed for Chapter 11 bankruptcy on July 8. The Seattle-based company, which was founded in 1972, plans to close 56 of its over 125 stores.

Muji

The American arm of Japanese-owned Muji filed for Chapter 11 bankruptcy on July 11. The lifestyle retailer, known for its minimalist aesthetic, operates 18 stores in the United States, and plans to close some of them as part of its reorganizing.

Ascena

Ascena Retail Group, which owns several women’s and girls’ clothing brands, filed for Chapter 11 bankruptcy on July 23. Ascena, which operates Ann Taylor, LOFT, Lane Bryant, Lou & Grey, and Justice, said via press release that it would close a “significant” number of the tween-targeted Justice stores and a “select” number of its adult-facing brands’ locations.

California Pizza Kitchen

California Pizza Kitchen, the casual-fare restaurant chain, filed for Chapter 11 bankruptcy on July 30. According to a letter from CEO Jim Hyatt, the company does not plan to close any of its 200-plus locations as part of the restructuring.

Lord & Taylor

Lord & Taylor, the nation’s oldest department store, filed for Chapter 11 bankruptcy on Aug. 2. The company sold to French retailer Le Tote and sold its 11-story New York City flagship location last year. The chain operates dozens of locations nationwide.

Tailored Brands

Tailored Brands, which owns suiting chains Jos. A. Bank and Men’s Wearhouse, filed for Chapter 11 bankruptcy on Aug. 2. In a press release, President and CEO Dinesh Lathi cited the pandemic as a factor, saying, “the unprecedented impact of COVID-19 requires us to further adapt and evolve.”

Stein Mart

Off-price department store Stein Mart filed for Chapter 11 bankruptcy on August 12. The chain, which was founded in 1908, plans to close most, if not all, of their 281 brick and mortar locations. In a press release, CEO & CFO Hunt Hawkins, cited “the combined effects of a challenging retail environment coupled with the impact of the coronavirus pandemic.”

Century 21 Department Stores

Off-price retailer Century 21 filed for Chapter 11 bankruptcy on Sept. 10. The department store chain, which operates 13 locations in four states, has been offering shoppers low prices on designer goods since 1961. Co-CEO Raymond Gindi cited lack of insurance funding as a reason for the business closure.

Town Sports International

Town Sports International, parent of gym chain New York Sports Club and similarly named franchises in Boston, Washington D.C., and Philadelphia, filed for Chapter 11 bankruptcy on Sept. 14. The company says customers should not plan to see a break in service, and that employees will still receive wages and benefits.

Sizzler USA

Sizzler USA, the operator of the casual steakhouse chain, filed for Chapter 11 bankruptcy on Sept. 21. The 62-year-old brand cited the filing as a direct result of pandemic financial strain and said it plans to keep all of its 14 company-owned locations open, according to a press release. Sizzler also has more than 90 franchised locations.

Ruby Tuesday

Ruby Tuesday, the 100-year-old dining franchise, filed for Chapter 11 bankruptcy Oct. 7. “This announcement does not mean ‘Goodbye, Ruby Tuesday,’” CEO Shawn Lederman said via press release. The company says it intends to run its nearly 600 restaurants as usual during restructuring.

Friendly’s Restaurants

Friendly’s parent company, FIC Restaurants, filed for Chapter 11 bankruptcy on Nov. 1. The company, founded in 1935, operates ice cream restaurants on the East Coast. “We believe the voluntary bankruptcy filing and planned sale to a new, deeply experienced restaurant group will enable Friendly’s to rebound from the pandemic as a stronger business,” CEO George Michel said. All 130 company-owned locations are expected to stay open and jobs will be preserved.

Guitar Center

Music product retailer Guitar Center filed for Chapter 11 bankruptcy on Nov. 21. The 60-year-old company does not plan to close stores during the reorganization. In a press release, CEO Ron Japinga said the filing will “enhance our ability to reinvest in our business to support long-term growth,” but did not give an explicit reason for financial strain.

Final Thoughts

This stock market is headed higher. As the carnival barker says, where it stops nobody knows. The S&P 500 is at an all-time high today. If it drops by 5% should you buy the dip? Certainly. If it drops by 10% should you buy the dip? Maybe, or maybe not. And if it drops by 15% should you buy the dip? Only if you are a True Believer in a quick return to normalcy in the economy, the pandemic, and corporate earnings.