“Double, Double, Toil and Trouble

Fire Burn and Cauldron Bubble

By the Pricking of My Thumbs

Something Wicked This Way Comes”

-Shakespeare's Macbeth (Act IV, Scene I)

It has often been said that asset bubbles can’t be identified except in hindsight. I disagree. But I do agree that bubbles can continue to inflate for months or years after they are first identified. This is where we are today.

We are now in the most overpriced market in history, bar none. We can, and probably will, go higher as the speculative juices of investors cause them to continue to buy equities with little regard for valuations or market history.

Irrational Exuberance

Perhaps the most classic example of an asset bubble continuing to inflate for years after it was first identified came in December 1996, when then chairman of the Fed Alan Greenspan spoke these famous words:

“Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

This quote was interpreted as a warning that Greenspan was worried that the stock market might be overvalued, and yet the market kept marching higher for the next four years. When this bubble finally burst in 2000, the NASDAQ fell 78% from peak to trough, leaving in its wake a slew of dotcom bankruptcies and the broken dreams of investors who thought we were in a new era of unending prosperity.

How overvalued are we?

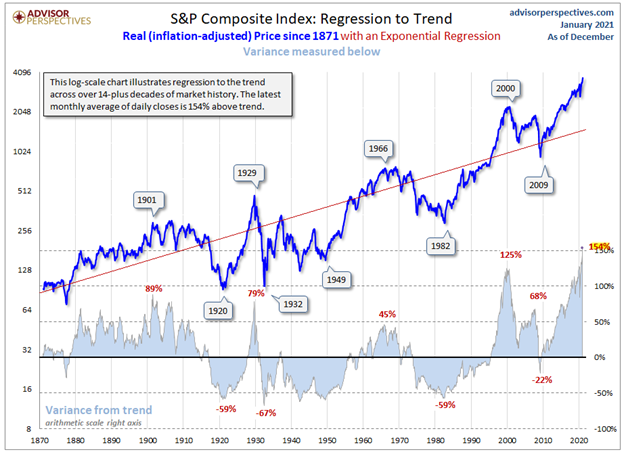

As the below chart from Jill Mislinski at dshort shows, we are now officially in a stock market bubble. We could be in the early stages or the late stages, but it’s a valuation bubble, nonetheless. According to Ms. Mislinski,

“The peak in 2000 marked an unprecedented 129% overshooting of the trend - substantially above the overshoot in 1929. At the beginning of December 2020, it is 154% above trend. The major troughs of the past saw declines in excess of 50% below the trend. If the current S&P 500 were sitting squarely on the regression, it would be at the 1457 level.”

How do you invest in a stock market bubble?

First, it’s reasonable to assume that our current bubble will continue to inflate, but it’s unknowable how far it may go. Therefore, I’m advising clients to stay invested for now. Speculation is rampant, margin borrowing is high, money is cheap (or free), Covid vaccines are rolling out, and more stimulus checks are on the way.

Investing while in a bubble requires defensive tactics. This could take the form of long-dated out-of-the-money puts on your preferred index or selling out-of-the-money calls against your holdings or writing a Plan B that reduces equity exposure as the market begins to decline.

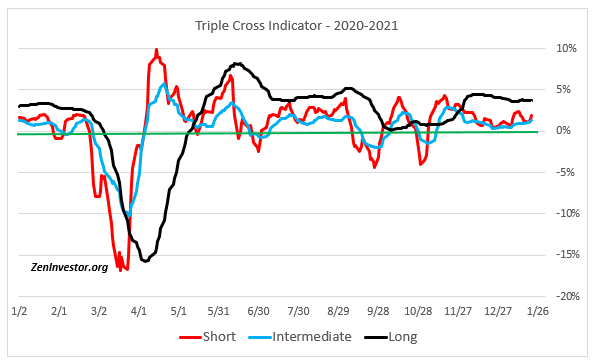

For example, I have a moving average crossover system that tracks the short, intermediate, and long term moving averages. When the short term MA turns negative, I raise some cash. Same with intermediate and long term MAs. This strategy ensures that you will be out of the market when the bubble finally bursts. The downside is that you will probably give up some of the upside (but not much) if the market continues to rocket higher. Here’s what my MA strategy looks like:

As of today, January 22, all three MAs are positive, which means my clients who use this system are 100% long equities. When the bubble bursts, this strategy will have moved them to 100% cash or bonds before the big down arrives. (This strategy returned 26% in 2020, vs. 16.6% for the S&P 500.)

Next, with a nod to Tiny Tim, let’s take a Tiptoe Through the Tulips and review the biggest asset bubbles in recorded history.

The Dutch Tulip Bubble

During the Dutch Tulip Bubble in the 1600’s, tulip prices soared twentyfold between November 1636 and February 1637 before plunging 99% by May 1637. Bitcoin is the closest analog in modern times.

The Bitcoin market echoes Tulipmania in the sense that nobody knows what a Bitcoin is actually worth. Just as 17th century Dutch speculators were doing, today’s Bitcoin speculators are basing their investments on hopes and dreams. Bitcoin recently traded above $40,000. Can it go to $50,000, or $100,000? Who knows? To a speculator, whether in tulip bulbs or Bitcoins, hope springs eternal.

The Tulip Folly, by Jean-Léon Gérôme, 1882. A nobleman guards an exceptional bloom as soldiers trample flowerbeds in a vain attempt to stabilize the tulip market by limiting the supply.

The South Sea Bubble

The South Sea Company was formed in 1711 and was promised a monopoly by the British government on all trade with the Spanish colonies of South America. Expecting a repeat of the success of the East India Company, which provided England a flourishing trade with India, investors snapped up shares of the South Sea Company.

As its directors circulated tall tales of unimaginable riches in the South Seas (present-day South America), shares of the company surged more than eightfold in 1720, from £128 in January to £1050 in June, before collapsing in subsequent months and causing a severe economic crisis. (Investopedia)

\

The "night singer of shares" sold stock on the streets during the South Sea Bubble (Amsterdam, 1720)

Japan’s Real Estate and Stock Market Bubble

In the present day, asset bubbles sometimes are fueled by overly stimulative monetary policy. Japan’s economic bubble of the 1980s is a classic example. The yen’s 50% surge in the early 1980s triggered a Japanese recession in 1986, and to counter it, the government ushered in a program of monetary and fiscal stimulus.

These measures worked so well that they fostered unbridled speculation, resulting in Japanese stocks and urban land values tripling between 1985 and 1989. At the peak of the real estate bubble in 1989, the value of the Imperial Palace grounds in Tokyo was greater than that of real estate in the entire state of California. The bubble burst in 1991, setting the stage for Japan’s subsequent years of price deflation and stagnant economic growth known as the Lost Decade. (Investopedia)

The Dotcom Bubble

When it comes to sheer scale and size, few bubbles match the dotcom bubble of the 1990s. At that time, the increasing popularity of the Internet triggered a massive wave of speculation in “new economy” businesses. As a result, hundreds of dotcom companies achieved multi-billion dollar valuations as soon as they went public.

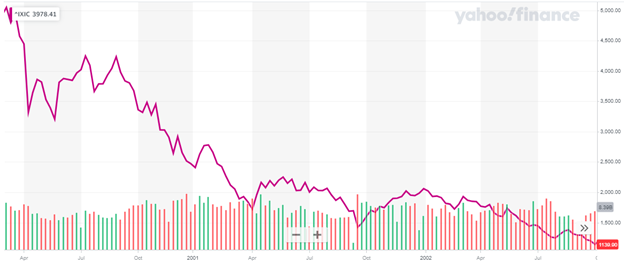

The NASDAQ Composite Index soared from a level of under 500 at the beginning of 1990 to a peak of over 5,000 in March 2000. The index crashed shortly thereafter, plunging nearly 80% by October 2002 and triggering a U.S. recession. The next time the Index reached a new high was in 2015, more than 15 years after its previous peak. (Investopedia)

Chart of the NASDAQ Index from peak to trough

The U.S. Housing Bubble

While U.S. house prices nearly doubled from 1996 to 2006, according to a report from the U.S. Bureau of Labor Statistics. Even as house prices were increasing at a record pace, there were mounting signs of an unsustainable frenzy—rampant mortgage fraud, condo “flipping,” houses being bought by sub-prime borrowers, etc.

U.S. housing prices peaked in 2006, and then commenced a slide that resulted in the average U.S. house losing one-third of its value by 2009.2 The U.S. housing boom and bust, and the ripple effects it had on mortgage-backed securities, resulted in a global economic contraction that was the biggest since the 1930s Depression. This period of the late 2000s thus came to be known as the Great Recession or the Global Financial Crisis (Investopedia)

Chart of the S&P 500 from peak to trough

Final Thoughts

In a bubble market the game begins to resemble Musical Chairs. When the music stops, who will have a chair and who will leave the game. The True Believers will continue to buy every dip in the market. They have made lots of money thus far. But at some point, there will be a “Come to Jesus” moment when they realize that the game is over. The bubble has burst and everyone around them is headed for the exits. And they will suffer significant losses, due to their stubborn clinging to the ever-expanding bubble myth.

It would be much better to have an exit plan in place. A well-constructed exit plan can save you 20%-50% of your invested wealth. Hire a CFP. Hire an Advisor. Hire Investing Coach. But don’t play Musical Chairs with your Nest Egg.

Your thoughts echo my feelings. The three averages "tool" seems like a simple enough idea that even as unsophisticated an investor , as myself could read, understand and utilize it. Where on the net may I find or build one? As the portfolio is very critical to my soon to come (3-5 years in the future) retirement.. I have grown it from $20K to $125K in the past three and a half years and would really be hurting should it lose 50%. I very much enjoy each and every one of your articles. Thank you

Thank you very much for the kind words. The Triple Cross Indicator has been so successful that I’m trying to find a way to offer it to subscribers. One way would be to include it in my Monthly Intelligence Report. I would send out alert emails to subscribers when the indicator changes.

Another way would be to make it a stand alone service with weekly updates. I do the work and you make the trades, if any.

A third way would be for you to hire me for a limited consulting assignment, where I would show you how to build your own model from scratch. That way, you would pay the initial cost and not have to pay any recurring subscription fees. You would own it and it would reside on your own computer.

I have done a few of these third options, and those who used it have been very pleased so far. It has taken an average of two phone sessions plus several back and forth emails to nail everything down. The total cost has ranged from $300-$400 per client. (I chargr $150/hr for my time.)

Let me know if any of these choices appeal to you.