A quick summary

- The Gamestop drama has revealed some important information

- The tail (the day trading hive) is wagging the dog (the big money)

- Volatility is rising, but upward momentum is slowing

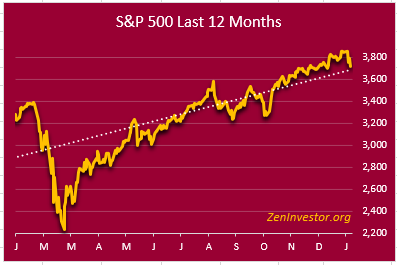

The S&P 500 was down 3.3% last week.

It was a bad week, down 3 out of 5 days. But it wasn't a terrible week, historically speaking. A look at the below chart shows that we have barely touched the 1-yr trendline.

Thanks to the dip-buyers, the market rarely spends much time in negative territory relative to the 1-year trend. How long this upward momentum can continue is debatable. It all depends on earnings estimates going forward.

Volatility is rising.

The long-term average for volatility, as measured by the VIX index, is around 12-14. Today it's more than twice as high. You can't read too much into the VIX numbers but something is afoot.

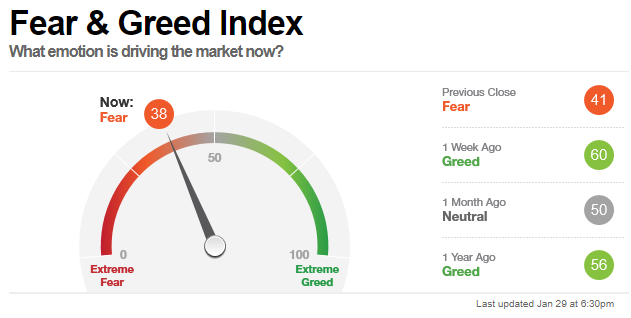

The Fear-Greed Index

CNN Business publishes an index that tracks the balance between fear and greed among investors. Here is the most recent reading.

After spending several months in the greed side of this indicator, investors are noe becoming more cautious about what's coming next.

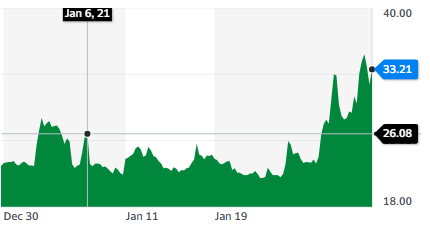

Gamestop

We've all seen this chart before, or variations of it. The question is, how can a company that is near death's door and closing 400 stores, suddenly take off like a supernova? This is the Gamestop drama.

Ignore the popular narrative that says the millennials are raging against Wall Street fat cats. I call bullshit. That's just clickbait. Closer to the truth is that the day traders have developed a hive mentality and someone is talking their book.

Picture a small cohort of millennial day traders who get the idea in their head that they can create an investment strategy that goes viral. They scan the SEC reports and find that Gamestop is one of the most heavily shorted stocks ever.

The leader of the hive, undoubtedly a smart and savvy day trader, comes up with a plan. If our hive can start to buy GME in a coordinated way, we might get some help from the Algo traders who will pile on to our buying.

Then, if we take the stock price high enough, we might be able to force the shorts to begin covering (buying GME in big chunks.) And that's exactly what happened. It wasn't a political statement about the inherent unfairness of Wall Street. It was just a bunch of day trading Jabronies, sitting in mom's basement, trying to figure out how to execute a pump-and-dump scheme.

And it was brilliant. It worked. And some GME buyers made a ton of money. However, like all pump-and-dump schemes, it will end in a trail of tears, with the most naïve players riding the stock as it eventually drops to zero.

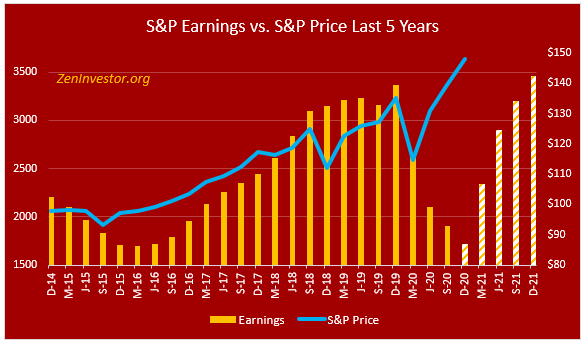

Earnings & Earnings Estimates

The chart below shows the S&P 500 (blue line, left scale) superimposed on the quarterly per-share earnings of the S&P 500 (gold bars, right scale). The last five bars are earnings estimates going forward.

The market is forward-looking and it seems to be counting on those rosy earnings estimates to hold. I'm not so sure. Wall Street analysts are usually too optimistic with their estimates and downward revisions are common as we get closer to the current earnings season.

What I see in this chart is the potential for market corrections as analysts begin to rein in expectations.

Final Thoughts

Gamestop is a cautionary tale. It highlights the speculative nature of today's stock market. In the coming weeks and months we will undoubtedly hear stories about GME millionaires, but the vast majority of the GME hive will lose money.

That's just how things work in the stock market. Those who are early to get in, like any Ponzi Scheme, will benefit handsomely. The other 90% will take a beating. And life goes on.