Follow the Money to Find Out

What's Working This Year

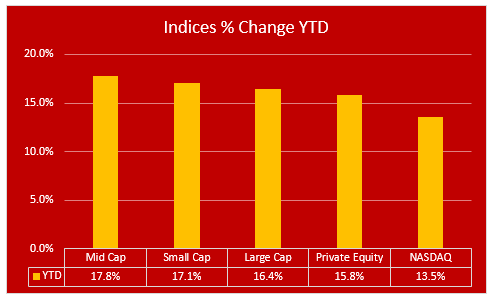

Major U.S. Stock Market Indices

As expected, all of the major US equity indices moved in concert, but there are a couple of things to note. Mid Caps have improved compared to 2020's full year 13.5% gain. And it only took half-a-year in 2021 to gain 17.8%.

Private Equity is also well ahead of its 2020 gain of 12.5%. But the big disappointment so far this year is the tech-heavy NASDAQ, up 13.5% YTD after being up 44.9% last year. Tech appears to be making a comeback recently, but it will be hard to beat last year's performance.

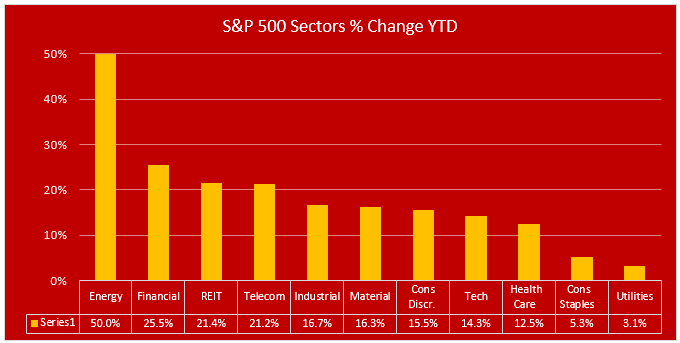

S&P 500 Sectors

In 2021, energy is where the money is going. The rebound from last year's decline of -33% is eye-catching. The same can be said for financials, up 25.5% after losing 2% last year.

Consumer Discretionary stocks led the pack last year, up 48.4%. This year they're struggling to keep up with the S&P 500 index. The same is true for tech.

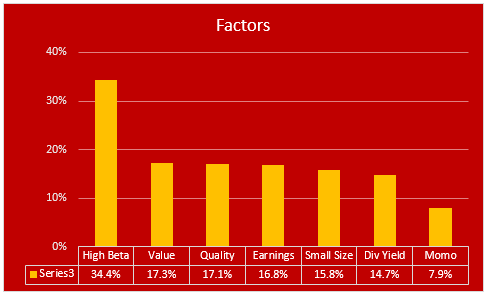

Stock Market Factors

High-Beta stocks are the place to be this year, up 34.4%. And they were up 25% last year, second only to Momentum stocks, which were up 29.9% in 2020. But money is flowing out of Momentum stocks this year, and much of it is going into Value names.

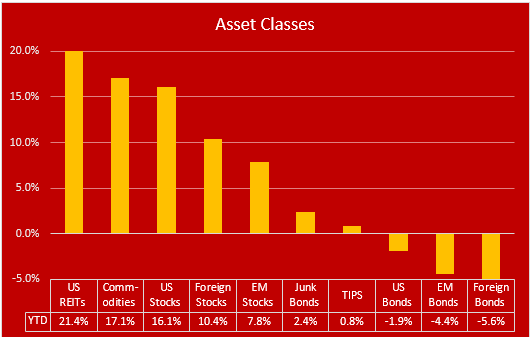

Global Asset Classes

US REITs have rebounded strongly from last year's -4.6% decline. Commodities are likewise having a strong showing compared to last year.

Foreign bonds are going the other way, down -5.6% YTD after being up 9.5% last year.

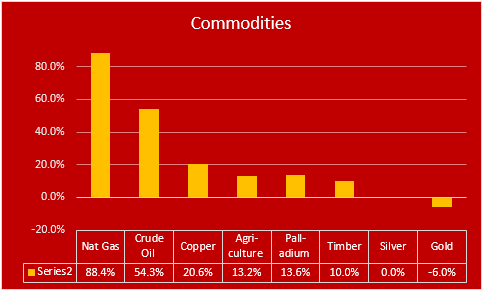

Commodities

After many years in the doldrums, commodities are finally having their day in the sun. Natural Gas and Crude Oil lead the pack. Gold is in last place YTD after a gain of 23.9% last year. Barron's has an article that posits a rotation out of gold and into crypto. We'll see if that comes to pass as the year progresses.

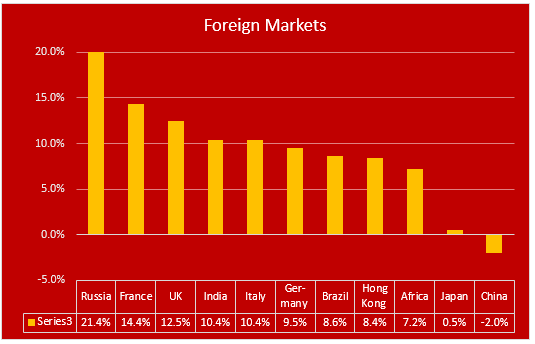

Foreign Markets

Russia leads the pack, after a flat 2020 performance. They are selling more oil, at higher prices this year.

The only country with a negative YTD return is China. Last year their market was up a tepid 6.9%.

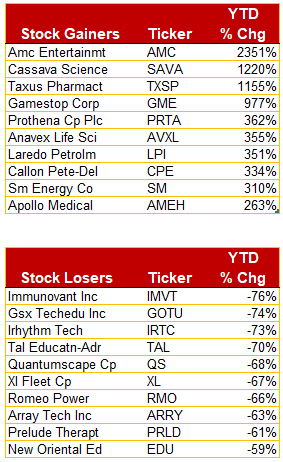

Stock Winners & Losers

The winner's list is dominated by meme stocks and energy stocks. No surprise there. The loser's list is a mixed bag. Here's hoping you don't own any of them.

Final thoughts

The market will continue to rise until the money stops flowing. I believe that gains in the second half of the year will be harder to come by. There are others who believe that we will see a final blowoff top that takes the S&P 500 to 4700 by the end of September.

Whatever you believe, keep a close eye on what the FED does. They control the money flow, along with our recalcitrant Congress who can't seem to agree on how much more fiscal stimulus is needed (if any).

And watch for a series of lower lows, followed by failed attempts to make a new high. The notorious dip-buyers have been aggressively supporting this market ever since the pandemic low point last year. If they become fully invested, the flow of new money into the market could stop.

We came to the point that nothing matters anymore in the markets. I do remember it in 1998 , it took 2 more years for additional gains in QQQ. I am not a genus and I have no idea where the market will be in future. Who knows what will happen in future. My point is that, I DO NOT LIKE IT, it is new era or new bust. Peoples madness is unpredictable. Inflation is up a lot and where we will go from here. I thing will be no winners in this game. Government and central banks will win this game { adjust to inflation }. Governments do survive when it in slaves the most of population { Roman Empire to present } . Good luck to everybody !