The headline numbers don't tell the story.

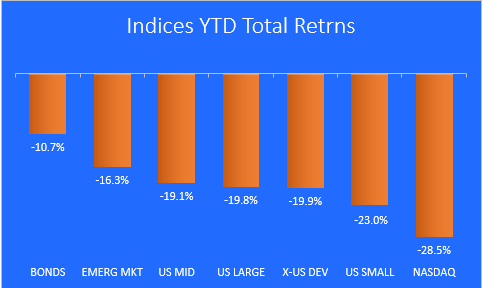

Global Market Indices

The market X-ray shows that bonds have been the most resilient of the major indices so far this year. In years past, bonds would be showing a small gain during a turbulent market, but this year they are down 10.7%.

Investors know that rates are headed still higher this year, so they are looking elsewhere for shelter from the equity storm. Bonds are widely expected to perform poorly for the remainder of this year.

Emerging Markets are holding up better than the rest of the equity markets so far this year.

Small-caps are struggling to keep up with their larger brethren. They are down -23% YTD.

In last place is the tech-heavy NASDAQ Composite index, which is now in a bear market, down by -28.5%. The 7 largest tech stocks combined are down by an average of 32% YTD. These same 7 stocks led the market higher last year.

All of the return data in this article is from Morningstar.

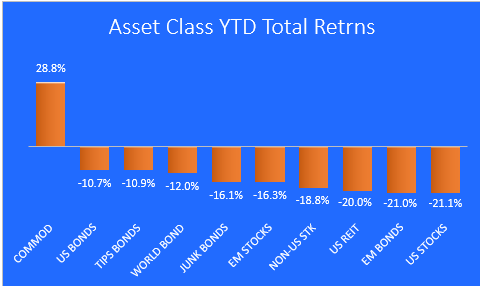

Global Asset Classes

Commodities were the best performing asset class in 2021 and they are still in the top spot so far this year. Energy stocks have been leading this asset class higher.

Bonds are holding up better than equities YTD. When adjusted for inflation, real yields are still negative almost everywhere you look.

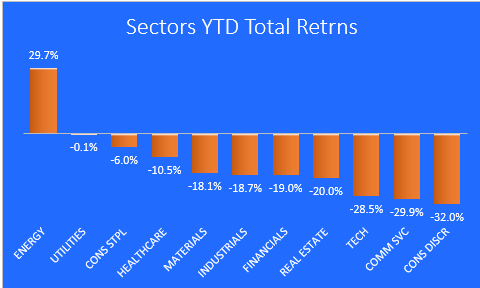

Stock Market Sectors

After gaining 54.4% last year, energy stocks are miles ahead of the pack this year. Geopolitical tensions are adding fuel to the fire for these oil & gas producers, pipeline companies, and refiners.

Communication Services stocks are struggling this year, along with Consumer Discretionary and Technology stocks. There is increasing concern out there that an overly aggressive Fed could tip the economy into recession later in the year.

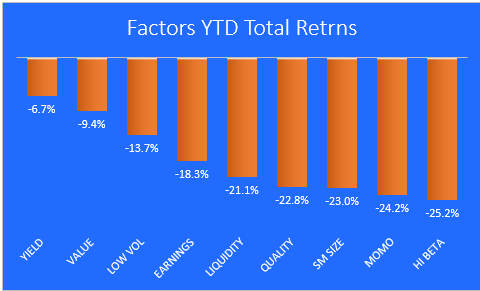

Stock Market Factors

The market X-ray shows that high dividend yield and value stocks are the most preferred factors so far this year. The yield factor is essentially value plus a dividend.

Momentum and high beta stocks have been shunned by investors, partly because they tend to have higher P/E ratios and therefore they suffer more when market multiples are contracting, as they are now.

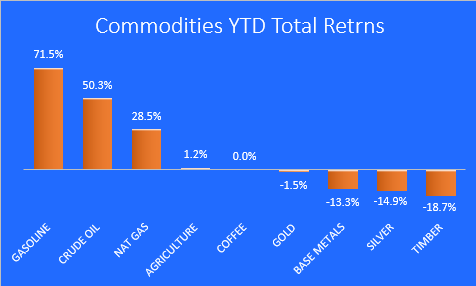

Commodities

After spending years at the bottom of the tables, Gasoline, Crude Oil, and Natural Gas now led the pack. Gold, Silver, Base Metals and Timber are down YTD.

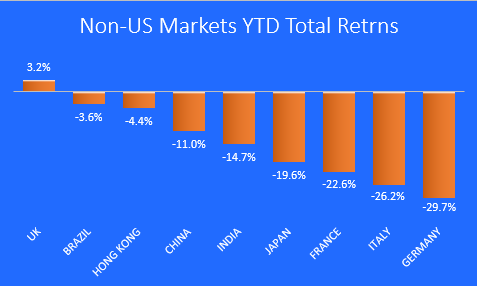

Foreign Markets

UK stocks are up YTD. Germany, Italy, and France are struggling, partly due to their heavy dependence on Russian energy imports.

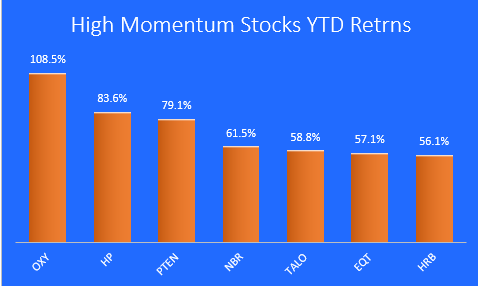

Momentum stocks

These stocks are showing strong momentum for 3 months, and year-to-date periods. This is a small sample of where the money is going now.

It's not too late to buy the energy names, even after a big rally in 2021 and a continued rally this year.

In fact, all of these momentum names score high or at least above average, and they are not considered expensive relative to earnings growth projections.

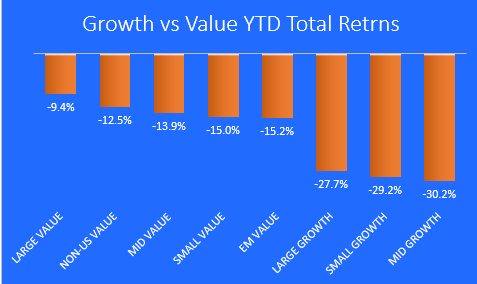

Stock Styles

The market X-ray shows that value stocks are the place to be in 2022. I think this relative outperformance will continue throughout the year.

Growth stocks are clearly out of favor right now. I think they will rebound from here, but I think 2022 is the year for value.

Final thoughts

For the second half of 2022, I like energy, commodities, healthcare and REITs. I lean towards value over growth. I also think 2022 will end up being a better year for non-US markets, especially Emerging markets. The wild card is China, If China goes down, they could drag much of the developing world with them.

Investors largely believe that the Fed will not allow this bear market to get much worse. However, inflation may force the Fed to tighten more aggressively than what is already priced in. If we see a lower print on the CPI for June, I think the market will rally, maybe as much as 10% above the recent low of 3666 on the S&P 500.

Added to inflation worries is the persistent decline in earnings growth estimates. If estimates for this year and next year continue to come down, I think the market will react badly.

I'm hopeful that we will end the year somewhere around 4500, but not until we find a bottom that is low enough to attract and keep the dip-buyers. My guess is down 25% from the January high water mark.

Hi Erik,

I really do need help and a change but I am afraid because I do not understand the logistics of

working with you. Do you help me adjust what I have tell me what to do with it and what

to purchase and how much? Do you consider the tax implications and percentages and make recommendations based on my entire net worth? Sandy