This article, and those that follow, are excerpts from the upcoming book...

The Zen Investor's Guide to Mastering the Tradecraft of Investing.

Introduction

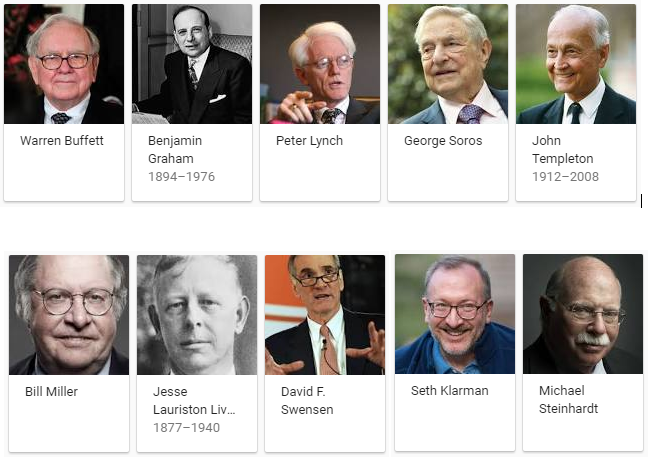

You have probably heard the names and stories about some of the Masters of Investing pictured below. They are a rare breed in the investment world, but they are out there. Here are a few of the most recognizable ones.

What these Masters have in common is a long record of outstanding performance. They share certain character traits, like a strong work ethic, above-average I.Q., self-awareness, emotional intelligence, humility, and patience.

I’ve been studying these great thinkers for decades. I read their books, their letters to shareholders, and I listen to the speeches they give at industry conferences.

I estimate that, out of the roughly 100 million investors in the U.S., there are probably no more than a few thousand who have achieved true Master-level competency. However, for any investor who has the will, the time, and the commitment to learn the right skills, it is not only possible, but indeed likely, that they will one day become a Master.

The Good News

Every investor has some of the characteristics of the greatest investors of all time.

- A functioning brain that scores average or higher on a standard I.Q. test.

- An interest in the market

- A desire to sharpen your skills and improve your results.

But it takes more than this to become a Master at the Investing game.

The Bad News

There are other characteristics that aren't as easily available to us. For example:

- You have to be willing to put in the time and effort it takes to learn the game.

- It takes an open and curious mind.

- It takes humility to recognize that sometimes your decisions will be wrong.

Even Master investors will encounter long stretches of bad luck, bad markets, and bad decisions, but they always find a way to learn from these rough patches. They are willing to look at their mistakes and ask "what could I have done differently?"

If you have been getting portfolio returns of 6% to 8% per year, which is average for retail investors, it is reasonable to expect that you can increase that to 10% to 12% per year. That is, if you are motivated enough to do what’s necessary.

The Crux of the Problem

And that brings us to the crux of the problem for a part-time investor who wants to be better at the game. It's not the amount of money in your bank account that matters. It's the amount of time it takes you to accumulate it.

If you suffer a bear market like we had in 2008 or 2001, it will set you back 10 years in your effort to build real financial security. But if you know how to play proper defense, you can reduce this loss of time by half or more. The end result is that you will reach your goals much faster than you would have without an effective defensive strategy.

The Tradecraft of investing can be learned

I’ve come to think of investing as a Tradecraft. I chose this label because I think it captures the true essence of what investing is, and what it takes to become proficient as an investor. Tradecraft is most often used in the context of spying. Specifically, spying as an employee of the C.I.A. Why do I think investing has anything to do with spying?

Because when you’re working for the C.I.A. (I have an uncle with 25 years in that job), the stakes are about as high as they can get. Life or death. It’s not quite that serious in investing, but it’s close. It’s retirement or not. Maintaining your lifestyle after you retire or living in a shotgun shack in the woods. Or, as Chris Farley so elegantly put it, "living in a van, down by the river."

So, the stakes for an investor are quite high, which means that your level of skill and competence will have a serious impact on what your life will look like after you are no longer able to collect a paycheck. I’ll have more to say about the skills that are shared by master investors and skilled C.I.A. agents later on.

The investing game

Investing is not a game in the entertainment sense of the word, but it does involve important elements of game theory.

Investing isn’t a science in the strict definition of that word, but understanding some key aspects of science can be very helpful.

Investing isn’t a sport, but there is an element of competition in investing. Remember that every trade that takes place involves a buyer and a seller, and they can’t both be right. Professional traders and portfolio managers dominate the market, with some estimates as high as 90% of all trading originating from skilled, informed, full-time career investors. It behooves the retail investor to ask him or herself how likely it is that the person who is taking the other side of your trade is wrong, and you are right.

I chose to call investing a Tradecraft because the term implies a few things to me. Things like the need for specialized skills, certain natural abilities, willingness to plan and prepare, courage of one’s convictions, open-mindedness and curiosity, situational awareness, and perhaps most important of all – uncompromising self-honesty and self-awareness. If you don’t know who you are, the investment markets are an expensive place to find out.

If you want to become proficient at investing, you’ll have to tackle some difficult issues. I lay these issues out in order of what I think is most important and helpful in the quest to master the Tradecraft of investing.Next time on Tradecraft...

Coming to an understanding of who you are as an investor is one of the most important requirements for mastering the tradecraft. Accomplished investors are constantly examining their assumptions, looking for clues that might reveal misperceptions or biases that could hurt their performance. It’s hard work for most, because it requires introspection and radical honesty. But I can guarantee you that going through it will make you a better investor.