Nobody Knows Squat

The world is in uncharted territory, and nobody knows squat about how things are going to unfold over the next few months. Maybe the pandemic will run its course by the middle of summer, and maybe we'll get a new second wave like we did in 1918 with the Spanish Flu. Who knows?

This uncertainty hasn't stopped "experts" from making predictions. A few of my favorites are...

"We're handling this China virus very strongly and it will be defeated very quickly." (Donald J. Trump)

"Unemployment could go to 20%" (Treasury Secretary Steve Mnuchin)

"Unemployment could go to 30%" (St. Louis Fed President James Bullard)

"This pandemic is no more serious than the flu." (Some jabroni on Reddit)

Enough, already. Nobody knows how this will all play out. So I turn to history for some parameters that will at least provide some context to our current situation.

Recessions throughout history

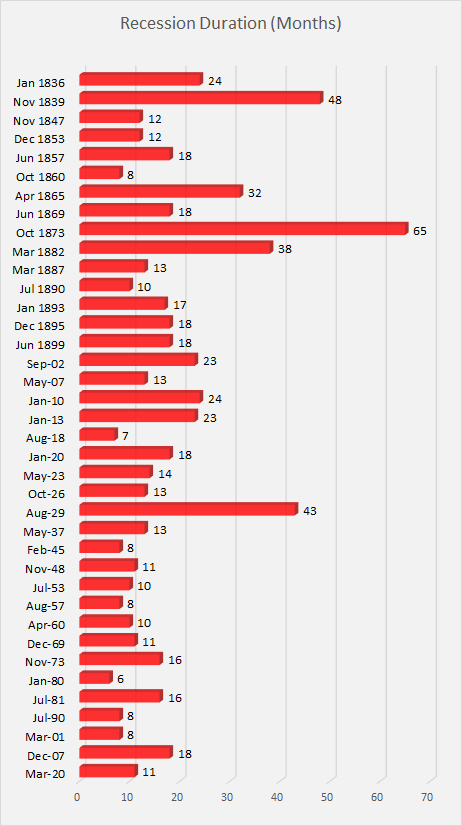

The chart below is full of past events in America that were influenced by panic and uncertainty. In every case, the world did not end and the economy recovered. There's little doubt that we're headed for a new recession, but the calls I'm hearing for a 1930's scale depression are premature at best and very harmful at worst.

The chart shows the duration, in months, for all 37 recessions we as a nation have endured since 1836. Highlights are the 4 year depression of 1839, the post-civil war recession which led to a lengthy period of general deflation that lasted until 1896, the 1873 depression which began with the failure of Jay Cooke & Company, the largest bank in the United States, which burst the post-Civil War speculative bubble, the 1882 recession which marked the end of the railroad boom in America.

And then we had the crash of 1929 and the Great Depression that followed. And that's when America finally woke up and said "no more." Massive policy and legislative measures were put in place to prevent this episode from ever happening again. A look at the chart shows how successful these efforts have been, at leat in terms of the duration of recessions post-1929.

The yet-to-be declared 2020 recession

I've taken the liberty to add the last line to the chart, under the assumption that we are either in, or headed for a new recession this year. I'm somewhat whimsically projecting that the 2020 recession will only last 11 months, based on the average duration of all recessions after the Great Depression.

There's no magic formula for this kind of forecast, but at least I'm using history as my guide as opposed to rank speculation.

Final thoughts

Another thing that history shows is that the stock market anticipates the onset of recessions by an average of 4 months, and the end of recessions by the same 4 months. If my wild guess that this recession started in March 2020 and lasts 11 months, that would mean the stock market could bottom out in November of this year.

Wouldn't it be great if forecasts were this easy? But they're not. It's just as likely that I could be completely off the mark. At least I have history on my side.

As I mentioned before. Money will become toilet paper all around the world. Read this and make your own decision.

https://wallstreetonparade.com/2020/03/for-first-time-in-history-fed-to-make-billions-in-loans-to-big-and-small-businesses/

Looks good!

Could You fix “recession duration ” chart. Would like to understand it. Spreadsheet is messing with years or months , do not make any sense. Thanks.

Andy, it might be a display problem on smaller screens. On my PC all the dates display correctly. If you can, open it on a big screen and let me know if you still have issues.

None of the recessions had the amount of fiscal and monetary stimulus in the trillions going into the economy. If congress actually turns on the spending machine as discussed, and with the fed already running the printing presses full blast this will be short recession. As soon as the virus cases start to fall the market will take off like a rocket.

Don’t listen to anyone….just watch the number of cases and be ready to quickly buy….on rocket day

Thanks for the comment, Howard, but I don’t share your optimism. Just wait until we get the unemployment report for March. It’s going to be a doozy. And wait until you start seeing the list of bankruptcies that are coming. And dividend cuts. This will not be a short recession, in my opinion.

So Eric what you are saying is that this is a short rally in the market then the market will likely drop for another 9 months approximately.

glefaw@telus.net

So to clarify Eric what you are saying is that this current rally is short lived and we can expect the market to keep dropping and bottom out in November. That would be the approximate time to invest in stocks.