Bear markets cause more harm than many investors realize. Anyone who has lived through a full market cycle, from the bull stage through the bear stage, knows how emotionally taxing a bear market can be. Not only do bears cause significant losses of wealth, they usually take years to recover from.

This article is about bear markets: their causes, their length and depth, and most importantly for investors, how to anticipate and even profit from them. Properly prepared investors can take advantage of the extreme pessimism that bear markets cause, and end up in a better position than they would be otherwise. How is this even possible? In practice, it’s not very difficult at all. What it takes is something I call “Situational Awareness,” which simply means paying attention to a few key indicators of market health.

It also requires a steady hand, because it’s very easy to jump in and out of the market prematurely, causing whiplash, unnecessary costs and losses of wealth. But a well-designed contingency plan will go a long way in preventing mistakes and getting investors out of harm’s way when the big downturns are coming. I will show you how this works.

After you read this article, be sure to explore the list of related material that I have linked to at the bottom. The more you know about the nature and causes of bear markets, the better you can defend yourself from the damage they can cause.

The worst bear markets of all time

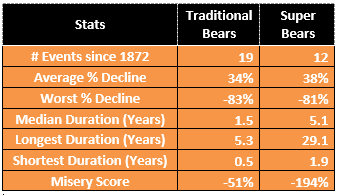

Below is a table of the worst bear markets since the Crash of 1929. Look it over, just to get an idea of how much damage these bear markets caused, in terms of their severity and their duration. Keep in mind that a bear market isn't over until investors are made whole again. I'll have more to say about that later on.

Since 1872 there have been 31 bear markets, defined as a 20% decline (or more) from the previous high-water mark. This means that bear markets come along about every 4.7 years. This, in turn, means that people who begin investing at age 25, and start withdrawing at age 65, will encounter at least 8 bear markets.

I think it's important to have a plan in place that lays out a defensive strategy that will at least reduce the damage caused by these bears. Even if that means simply cutting back on risk exposure slowly and methodically, any defensive strategy is better than nothing.

Severity of bear markets

In the table above you will notice that I have divided the 31 bear markets into two categories: Traditional bears, and Super bears. I did this because it's easier to just "ride out" a traditional bear than a Super bear. What's the difference between these two categories?

First is the severity, although it's not very different for the two categories. Traditional bears involve a decline of 34% from top to bottom, while Super bears decline 38%. But don't let this fool you. It's the duration of Super bears that cause most of the damage to investors.

Duration of bear markets

Traditional bears last, on average, about a year-and-a-half. That's a time frame that most investors should be able to tolerate without too much stress. But Super bears last much longer - 5 years on average. This kind of event causes stress, tests patience, and leads to all manner of poor decisions as investors try to cope with the prospect that the market may not recover for many more years.

Misery score

When we combine the severity and the duration of each bear market episode, we get the misery score. As you can see in the table, Super bears cause four times as much pain, stress, and anxiety as traditional bears. This is why I advocate for the use of a written, thoughtful, and specific defensive strategy that will provide practical steps one can take in dealing with the worst bear markets. More on that later.

Situational Awareness

It's my belief that the ability and willingness to get out of harm's way when the bottom is about to fall out is one of the most valuable, if not THE most valuable skills that an investor can acquire. More on that later.

Market timing is a fool's game

How many times have your read that market timing doesn't work? Jumping in and out of the market at the right time is a fool's game. And I wholeheartedly agree. In most cases the investor is making these timing decisions based on what their "gut" is telling them. There are two problems with this. First, there are many instances where a sudden and sharp drop in the market turns out to be a false signal. More often than not, the market finds its footing and resumes its upward climb to new highs.

The second problem is when to get back into the market once you're out. This is even tougher than the decision to get out, because that one was made out of fear. Getting back in requires nerves of steel, because by definition, the market has already fallen by 10% or 15% and it's impossible to know how much further it will fall.

That's why market timing, based on gut feel, is a fool's game. But market timing based on real data, interpreted by a robust methodology, is not at all a fools game.

Next time on Bear Markets

We have much more ground to cover regarding bear markets and how to avoid them. I will be writing a series of articles that explore various features and behaviors of bear markets, and how to anticipate them. In the meantime, check out some of my other articles that are related to the topic of bear markets.

Related Articles About Bear Markets

How to profit from bear markets and recessions

Why it's so important to avoid bear markets

A proven way to avoid bear markets

How to use the business cycle to avoid bear markets

The downside of passive investing