Set up a list of eligible securities for inclusion in your portfolio

Lesson 13 Module 3

You've done the heavy lifting. On to specifics.

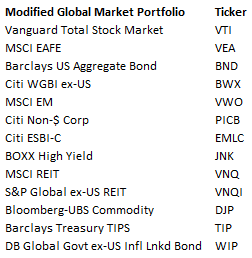

Asset Class ETFs

The below table is an example of an "eligibility list" of asset class ETFs. It contains 13 ETFs that cover 90% of the investable universe. There are 2,200 ETFs for you to choose from, but this is a good place to start.

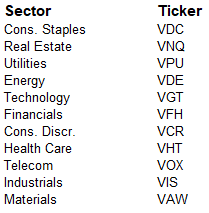

Sector ETFs

Drilling down from the global asset classes to U.S. market sectors, we find the below table. Use this as your guide when choosing which sectors of the U.S. market you want to include in your portfolio.

Individual stocks

You should establish some ground rules when it comes to including individual stocks in your portfolio. For example, will you allow penny stocks in? How about foreign stocks? Or so-called Fallen Angels that could turn into bankrupt angels?

What about dividend stocks? Growth or momentum stocks? Microcaps? It's beyond the scope of this course to recommend individual securities. That part is up to you. You set the rules and parameters, and give it some thought before you settle on your approved list.

Options, futures, commodities, leveraged & inverse ETFs

These are the securities that live on the extremes of risk and reward. It takes a gambler's mindset to play in this arena. Go there if you must, but be prepared to call 911 if you get into trouble.

Bottom line

Your portfolio is a sanctuary. Don't let anything in that doesn't belong. Make a list of eligible and non-eligible securities and stick to it. You can always tweak it by adding and removing the things that you haven't yet considered, but you are the gatekeeper, and the bouncer, and the enforcer. Do your job.