A different way of evaluating the correction we are in.

As regular readers know, I like to look at market corrections, bears, and super-bears from various vantage points. This gives me some perspective on how serious each of these episodes are, and what investors should or shouldn’t do about them.

This article looks at our current correction from the vantage point of the number days spent wandering in the wilderness. The idea is to measure how many days the market has been “under water” and compare it to the historical record of all corrections and bear markets.

Why do I think this is helpful? Because of something an old friend and mentor once asked me – “How many times do you want to earn the same dollar?” I think that’s a rather profound question for an investor to ask. It addresses an uncomfortable truth that the Buy & Hold tribe would rather not talk about. Namely, the enormous amount of time that’s wasted when the market is between new highs.

Money is Time

Everyone knows that Time is Money, but it’s a little harder to recognize that Money is Time. If we agree that the whole point of investing is to accumulate enough money to sustain us when we can no longer produce an income from working, it stands to reason that the faster we get to our accumulation goal, the sooner we can begin to relax and not worry as much about our financial security.

When the market is under water (trading below its high-water mark), it means that our forward progress in terms of our financial goals is on hold. I call these periods “days spent wandering in the wilderness.” My old friend called them “earning the same dollar over-and-over again.”

Time is one of our most precious resources, and nobody I know wants to waste it unnecessarily. We all have activities that are time-wasters, like social media, video games, and waiting for the cable guy to show up. But those time-wasters serve a purpose. It’s good for us to play around and give our brains a rest occasionally, and the tardy cable guy or the waiting room at the DMV are just facts of life. But what about our investments? Do we have a choice, or do we just have to wait out the market like we wait for so many other things in our life? My opinion is no. There are things we can do to “jump the line” without causing a ruckus.

Before we get to that, let’s look at the record of the longest stretches of wilderness wandering since 1950. In order to qualify, the market has to be under water for at least 10 days. Anything less than that is just the normal ebb and flow of the market.

The historical record

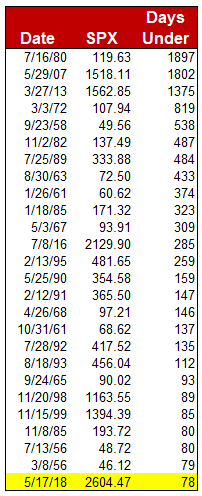

Table 1. Longest stretches of consecutive days spent “under water” since 1950.

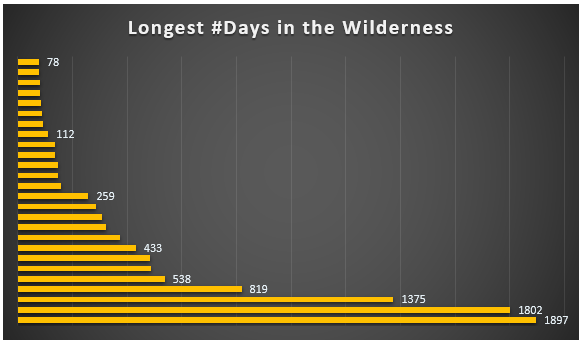

Here is the same data, in graphical format.

What we find is that since 1950 there have been 17,206 trading days. Of those, exactly 1,097 were new high-water marks for the stock market. That means all of the wealth created in the market comes from just 6.4% of trading days. The other 93.6% of days do not produce any gains in our net worth.

Put another way, the answer to the question of how many times do you want to earn the same dollar is… 14 times. That’s what an equity investor gets with a strict buy & hold strategy. These investors are destined to earn the same dollar 14 times before they begin to add to their net worth.

Now, before you get defensive about buy & hold, let me stipulate that it’s the best option for most investors. Why? Because every other strategy demands more of the one resource I’m trying to conserve – time. You can set up a globally diversified portfolio of low-cost index ETFs, and only spend about 30 minutes per year tinkering with re balancing. As soon as you start thinking about making adjustments to your portfolio more frequently than once per year, you are using up more of your precious “free” time.

What I am proposing

Most investors are focused on two things: what rate of return can I expect, and how much risk am I taking with my money. I propose a third area of focus – time. By including time in their investment strategy, investors will become more aware of the erosion that days in the wilderness can have on their forward progress. Buy & Hold investors don’t have to accept the fate that they will have to earn the same dollar 14 times. They can choose to do something about that.

For example, you can add a recession overlay to your regular buy & hold strategy. Recessions are infrequent, but devastating. Most of the longest days in the wilderness shown in the graphics above were connected to a recession. There are several high-quality recession forecasting services out there, and I recommend that you explore what they have to offer.

You can also add a bear market overlay to your regular strategy. Bear markets happen a little more frequently than recessions, but there are several bear market forecasting sources available that might be worthwhile to check out.

Final thoughts

The correction we are in now is not very deep, at -10.2% max drawdown so far. But it has gone on long enough to earn a spot on the leader board of wilderness days. It comes in at #26 out of 2,692 wilderness stretches of 10 days or more. That puts it in the top one-tenth of one percent. Most of us look at the market and say “we’re only down 5% from the all-time high, so what’s the problem?” I hope I’ve made the case that the problem is wasted time, not the severity of the drawdown.

If you want recommendations about recession or bear market forecasting services, contact me through my website.

curious on forecasting websites

Erik, can you be more specific as to adding “recession overlays” and “bear market overlays”? Thanks.

Please forward contacts concerning recessions and bear markets.

Thanks,

Curt Cedarleaf

I do not wander in the wilderness. As rates rise I keep buying treasuries when rates get high enough or something else brings on a recession the treasuries rally, I sell them and buy stocks in the recession.

As recession ends stocks rise. When rates start to rise again sell stocks, buy treasuries and start cycle over again.

Works every time. Made lot of money with no stress….

That sounds pretty good, anonymous. How to you know when a recession or bear market is coming?

Smart stuff, Erik