What will capital market returns be for the next 10 years?

There is a time-honored tradition on Wall Street where highly respected and well-compensated strategists offer their predictions about equity market returns for the next 10 years.. Specifically, stock market, bond market, oil, gold, REIT, and other assets. They don’t just predict the direction of the market, they go one step further and put a time frame on their prediction. In a purely rational world, this would be tantamount to Reputational Russian Roulette.

But in the realm of Wall Street prognostication, rationality is simply an afterthought. Why is that? Why do these high-profile experts stick their necks out with these predictions?

Here’s what I think. The only thing the financial media cares about is which of the predictions were the most accurate. These lucky guessers are celebrated as clairvoyant gurus, and their reputations (and their paychecks) get an upgrade.

Those who were off the mark don’t get punished. They are simply ignored. There is no downside for making predictions. Shows like CNBC and Bloomberg News will congratulate these lucky pundits on their skill and prescience and ask how they knew that things would turn out the way they did. This media attention not only burnishes their image, it also gives them a green light to publish a book and go on a media tour to promote it. Nice work if you can get it.

Everybody wants clear answers

This is a critical point for investors. One of the great myths of investing is that there are certain “experts” who know what’s going on and can see where the market is headed and which stocks will be the next big winners. But how can you tell the difference between a talking head who just wants to sell books, and a thoughtful student of the market? It’s not easy, that’s for sure.

The value of forecasting increases over time when done thoughtfully

When we look ahead 12 months or more, the value of a well-thought-out forecast begins to improve. And it continues to improve as we lengthen the time frame even more. But there is a natural limit to the value of forecasting. At about the 10-year mark, the accuracy (and therefore the value) of a forecast starts to peak because anticipating the health of the economy 10 years out is pure guesswork at best.

I prefer to operate within this one-to-ten-year time frame when it comes to making forecasts. I designed my forecasting models to reflect this. This article explores the accuracy and reliability of 10-year forecasts. We begin by looking at the historical record, so we can establish a baseline.

A Look at the Record Over the Last 120 Years

Equities have delivered the following annualized returns since 1900:

• 6.12% nominal (price only, excluding dividends).• 9.48% nominal (price change plus dividends).• 3.06% real (price only, adjusted for inflation).• 5.67% real total return (price change, plus dividends, adjusted for inflation.)

Before we go any further, let’s all try to agree on one thing. The only returns that matter are real total returns. Why? Because the whole point of investing (putting your life savings at risk) is to accumulate real wealth, net of inflation. Real wealth is purchasing power, not a number on your brokerage statement.

It does not matter very much if you earned a nominal return of 10% over the last 10 years if inflation was 12%. You gained nominal wealth, but that was just a mirage. What matters is that you lost purchasing power because your cost of living went up faster than your savings account balance. When the day arrives that you begin taking money from savings to finance your golden years, you will be worse off if your nominal returns didn’t beat the inflation rate by a healthy margin.

The Historical Record

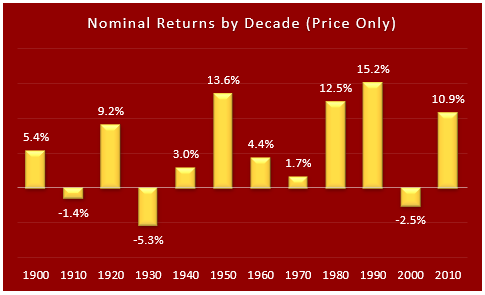

Chart 1. Average annual nominal returns, excluding dividends, since 1900.

This is the chart that most investors are familiar with. It shows the nominal returns of the stock market (before inflation and excluding dividends). A few things jump out for me. First, the average returns are very different for each of the ten decades under consideration. While it’s true that the average of the returns over the entire period was 6.12%, the variability of those returns is quite high. For example, investors in the 1930’s and 1940’s suffered the effects of the Crash of 1929, and the Great Depression that followed. It was not a good time to be invested in the stock market.

Those who were unlucky enough to have begun investing at the turn of the 21st century suffered through the lost decade of the 2000’s. But investors in the 1980’s and 1990’s hit the jackpot. They were lucky enough to be in the market during the best 20-year stretch in history.

My takeaway from viewing this chart is that when it comes to the stock market, timing is important. It’s difficult to know what’s in store for any coming decade, but it’s not impossible to know. Later in this article I will offer some ideas about how to be more invested in the good decades, and less invested in the bad decades.

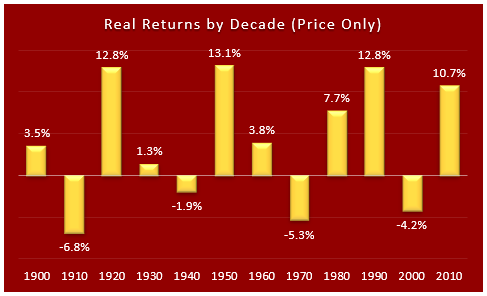

Chart 2. Average annual real nominal returns (including inflation, excluding dividends) since 1900.

This chart builds on the previous one by taking inflation into account. Inflation matters – a lot. The good part is that inflation allows companies to raise their prices, which keeps their earnings in line with growth in the overall economy. The bad part is that inflation erodes purchasing power. As long as the companies you’re invested in can raise prices to match inflation, you’re o.k. But some companies, like utilities, must get government approval to raise prices. That’s why they pay higher dividends than fast-growing companies.

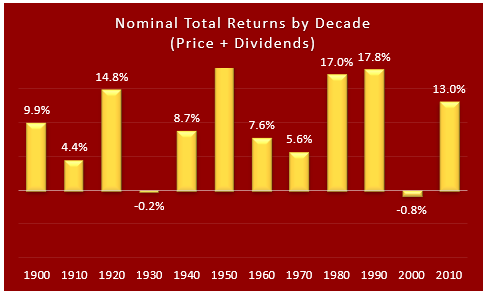

Chart 3. Average annual total returns, before inflation, since 1900.

Dividends are also important for investors. If you compare this chart (Chart 3) to Chart 1, you can see the big impact that dividends have on investment returns.

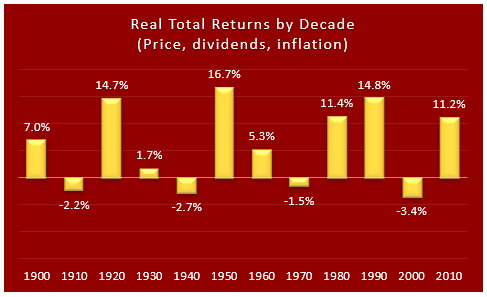

Chart 4. The most important chart in this article. Average annual real total returns since 1900.

Investing is really an extension of saving. It wouldn’t make much sense to keep your money under the mattress, earning zero interest, because every year your purchasing power would be eroding. Chart 4 shows the real (after taking inflation into account) total (including dividends) return that investors get.

Note that in this chart, as in the others, there is a wide variation in returns by decade. This is one of the main points of the article. An investor who has the foresight to look ahead 10 years will undoubtedly have better results than one who can only see things that are close by.

What drives stock prices

According to the late Jack Bogle, the inventor of the index fund, and a majority of academics who have studied stock market returns over the years, there are 3 primary drivers of equity returns:

1. The dividend yield.2. The rate of earnings growth.3. The change in the Market Price/Earnings ratio.

Most, but not all, of the other factors that influence stock prices eventually get reflected in these 3 primary drivers. I have taken the liberty to create a 4th factor, which I call the X-Factor, to account for the difference between the Forecasted return and the Actual return of the market.

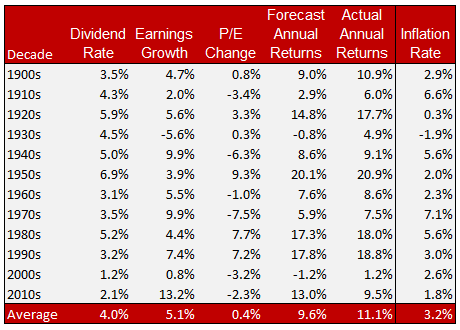

Mr. Bogle summarized the influence of these drivers in the table below. I find it enlightening, and I incorporate his thinking into my forecasting models.

Of the three main drivers of returns, dividends are the most consistent. The other two, earnings growth and P/E change, are far more variable from decade to decade.

Earnings growth is a function of the health of companies, which in turn is a function of the health of the economy. In a robust economy, earnings growth will be strong, and vice-versa.

The wild card in this analysis is the change in the P/E ratio. Think of it this way – how much are investors willing to pay for a stream of future payments? When investors are optimistic, they will pay as much as $25 dollars today, for every $1 dollar of future earnings. Does that sound insane to you? It does to me, but here’s why it’s true. The P/E ratio reflects investor sentiment, or how optimistic they are about the future. The stock market is driven by the emotion of investors as a group.

The problem is that there is no good way to estimate how this driver will change in the future. It’s pure guesswork. So, to make a reasonable guess about what the P/E will be 10 years down the road, I turn to my trusty old friend – mean reversion. Simply put, decades with very high P/E ratios are inevitably followed by decades with low ones. That’s mean reversion at work. I’ll have more to say about this when we drill down into the P/E numbers later on in this article.

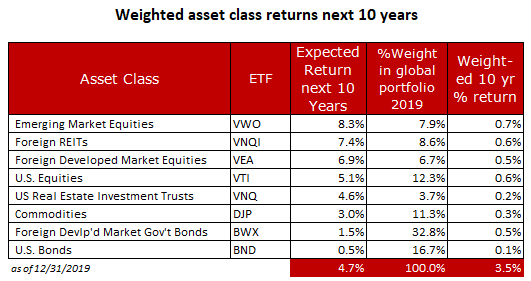

What about the next 10 years?

John Bogle, a man I highly respect, says that the next 10 years, equities are likely to produce annual returns of 4-5%. I think he’s too optimistic. Other top minds in the business are calling for near-zero returns. I remember clearly when UBS, the Swiss bank and wealth manager, went on the record in early 2000 with a forecast that we were about to enter a “lost decade” in the equity market. This was a radical position for a wealth manager to take, given the fact that their revenues were tied to clients who were invested in the equity market. This really made an impact on me at the time.

As it turned out, UBS was correct. The decade of the 2000’s was not kind to equity investors. Two severe bear markets and a near-collapse of the global financial system pushed the average annual returns down to negative numbers. If you were lucky or smart enough to see what was coming, and went to cash, you were spared but you didn’t make much money. If you went into Treasury bonds, you were not only spared, you made a decent return of 5-6% depending on the maturity.

Mean Reversion

The basis of my assertion that equity market returns over the next 10 years will likely be in the low single digits, if not negative, is my belief in the irresistible force of mean reversion. Market history gives us clues about how mean reversion works. In the Roaring 20’s, optimism permeated the financial markets. World War I was over, and Americans had a shared sense that better days were ahead. The stock market was on fire, and stories about cab drivers and shoe-shine boys bragging about the killing they made in the market should have been a warning that things had gone too far. But nobody wants to be the first guest to leave the party, so the market kept climbing until the music stopped in October of 1929. The following two decades were a classic illustration of mean reversion at work.

The same scenario played out after the end of World War II. In the 1950’s the economy was booming and the stock market had one of its best decades ever. But mean reversion asserted itself, and the 1960’s saw market returns drop from 13.3% down to just 2.3%. The next decade was even worse. The 1970’s served up an average annual return of minus 6.2%. Ask yourself, are you willing to ignore an overvalued market with the belief that things will always work out eventually? It’s a quaint idea, and one that is heavily promoted by the investment industry as the only reasonable choice for most investors. Buy & Hold through thick and thin is the mantra of the adviser community. They say market timing doesn’t work. But think about the benefits to the investment adviser that accrue from this point of view.

Advisers, fund managers, wealth managers, and the like are compensated based on the size of their book. The more client assets they have under management, the higher their compensation. What happens when a client leaves the stock market and shelters in cash or Treasury bonds? The adviser takes a direct hit to his or her bottom line. So it’s in their best interest to keep clients fully invested at all times, so they can maximize their revenue per client.

This doesn’t make them bad people. It’s a flawed business model that’s to blame. The next time your adviser tells you to “stay the course” when things are falling apart, ask yourself if that’s really the best way to proceed.

This is important: I am not calling for a severe bear market in the next 6-12 months. In fact, it’s quite possible that the market will shake off the current doldrums and go on to make new highs. But I am less optimistic about the longer-term prospects for the economy and the stock market. I believe that we are once again headed into a lost decade, where average annual returns will be minuscule, if not outright negative. Why am I so pessimistic?

First, valuations. I have several models that take the measure of equity valuations, and they all reach the same conclusion – this market is stretched. But that alone is not enough to be pessimistic, because there have been many periods in market history where high valuations were followed by even higher valuations.

This time around, we have some major clouds forming above the economy and the stock market. Let’s start with the elephant in the room – the ballooning of the budget deficit. This is not an immediate threat, but at some point, our debt burden will begin to impact our economy. Then we have the enormous balance sheet at the Fed. They are working to reduce it, and the only way to do that is to raise interest rates. They have already stopped buying questionable credits left over from the mortgage crisis, and they are signaling that they will continue to raise rates until their balance sheet is restored to some semblance of normality.

In a rising interest rate environment, who benefits and who gets hurt? Banks benefit because they can charge more for their loans. But the Federal Government itself is the real loser here. Since 2008 the Treasury Department has enjoyed ultra-low interest rates on their borrowing needs. But it looks like those days are over. If the 10yr bond goes to 3.5%, which is likely, the Treasury will face a significant increase in their cost of doing business.

I won’t go into the geopolitical risks we face, because that would require speculation about an unknown future. But I will say that this type of risk is higher today than it has been in many years. Enough said.

What’s an investor to do about all of this?

First, don’t panic. These things evolve slowly over time, so there’s no need to take immediate action. What’s called for is a well-thought-out contingency plan – one that is ready to go when the time is right. This plan should include several defensive steps to be taken thoughtfully and gradually as needed.

I won’t go into the details of how to design a contingency plan because every investor has different objectives, time frames, and risk preferences. Suffice it to say that vigilance is called for and start thinking about what steps you can take to protect what you have built over the last 10 years.

Here are links to related articles you might like:

Is Market Timing a Viable Strategy

Bull Case vs. Bear Case for 2020