It's been a rough 6 months for everybody, including investors. This article will focus on some of the best stock-pickers working today, and show that even they are having a rough go of it.

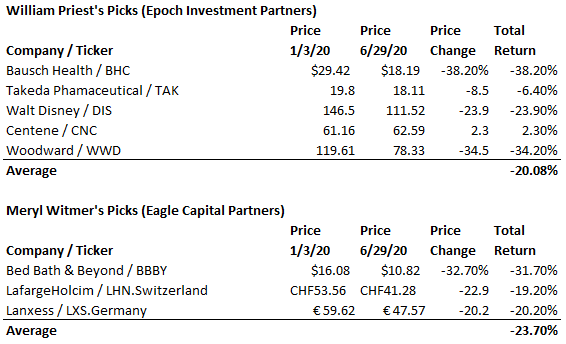

This week's Barron's has an article that shows the 6 month results of their Guru Roundtable of highly skilled stock-pickers. It's not surprising that many of them are struggling, just as the rest of us mere mortals are.

These Gurus went on record on January 3rd, 2020, with their top picks for the year. There were some fantastic winning picks, but many more clunkers (a technical term). I will show them all, from all 10 of these stock market savants, and you can draw your own conclusions.

What defines a stock-picking Guru?

For this article, the editors at Barron's defines them. (I disavow any responsibility for their selection process.) There are a few hurdles to overcome if you want to be included in the Barron's Roundtable of experts.

Track record. Barron's doesn't just let any guru-wannabe into the Roundtable. To be invited you must have a demonstrated and verifiable winning track record as a winning stock-picker. No exceptions. The problem with this is that recent winners often become losers, which is why the team of elite Roundtable members is constantly changing.

Longevity. The average number of years of stock-picking experience among the members is 23. Why is that important? Because superior stock-picking is very Darwinistic. If you had 10 years of outperformance followed by 3 years of underperformance, you will likely be replaced in the Roundtable lineup.

Visibility. If you happen to be working for Goldman Sachs, your place on the list is virtually assured, regardless of your occasional stumbles.

Global Reach. There are a few members who are based outside of the U.S. and this apparently has appeal to the membership selection committee. Barron's holds itself out as a global newspaper, even though most of their articles and staff recommendations are for domestic stocks.

Let's get to the results

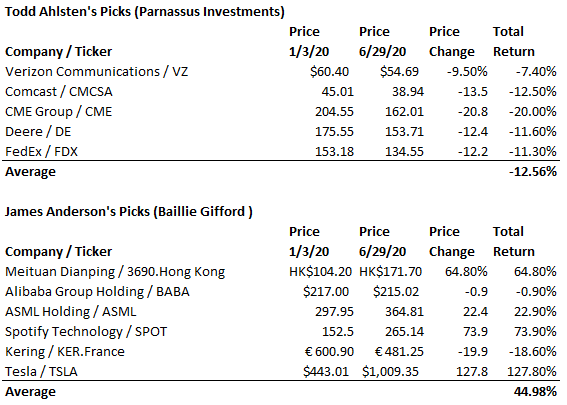

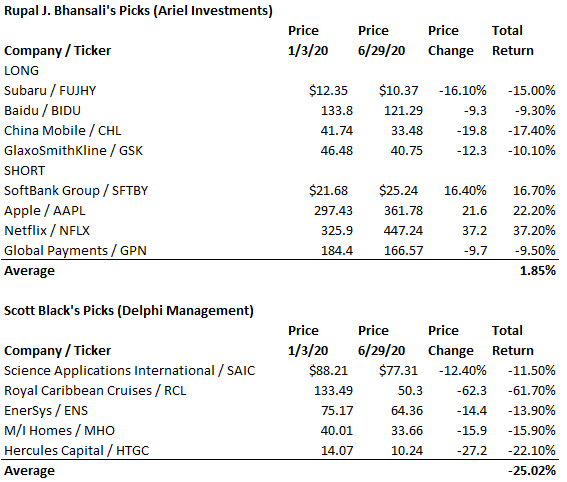

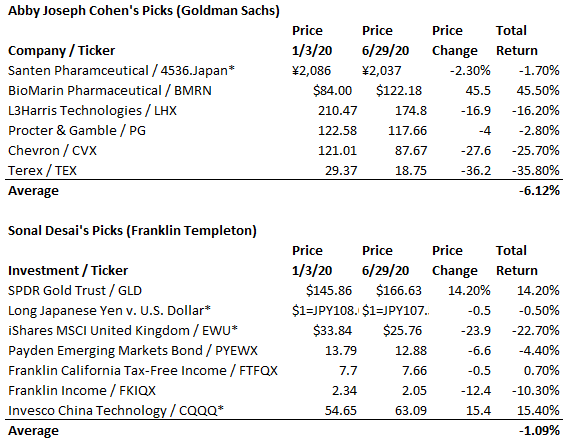

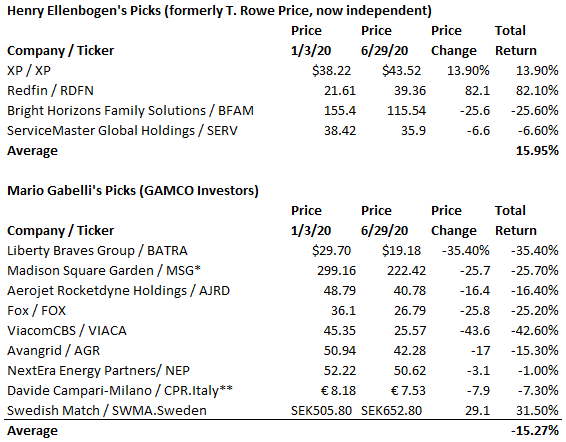

Keep in mind as you look at the results from each expert that the S&P 500 is down -4.7% on a total return basis for the same time period. At the end of this guru-by-guru accounting I show the best and worst of the bunch.

The summary

James Anderson put up spectaculsr numbers. How did he do it? He did it with three stocks - a Hong Kong company that you would never have even known about, let alone invested in; Spotify, which you should have known about but probably didn't pick; and Tesla, a company that nobody understands and is priced as if their next car plant will be built on Mars.

Was Anderson smart? No doubt. Will he be as smart for the next 6 months? Who knows. Mean reversion, as I've said before, is a bitch. Anderson might come in last place in the Guru 2020 sweepstakes.

The reality check

How did your portfolio perform in the first half of 2020? Some of the best returns went to true buy-and-hold types, if they didn't panic when the market crashed. Investors in Target Date Mutual Funds have also done well, unless they got spooked and sold out.

Do yourself a favor and calculate your gain or loss in the first 6 months of 2020. No cheating. Include all of your accounts in the calculation. I bet that you did better than some of these experts, and much worse than Anderson.

My stock picks for the next 6 months

Here is a sample of my picks for the rest of 2020. I have 100 stocks on my watchlist and these are 10 of the most promising.

- COMERICA INCORPORATED (XNYS:CMA)CMA $35.77

- ALASKA AIR GROUP, INC. (XNYS:ALK)ALK $35.73

- DELTA AIR LINES, INC. (XNYS:DAL)DAL $27.09

- TAPESTRY, INC (XNYS:TPR)TPR $12.62

- PVH CORP. (XNYS:PVH)PVH $44.37

- XEROX HOLDINGS CORPORATION (XNYS:XRX)XRX $15.49

- DXC TECHNOLOGY COMPANY (XNYS:DXC)DXC $15.49

- KOHL'S CORPORATION (XNYS:KSS)KSS $21.09

- MACY'S, INC. (XNYS:M)M $6.77

- NORDSTROM, INC. (XNYS:JWN)JWN $15.76

Thank you for sending the articles. Actually I follow your first two principles. Simplicity and Clarity.

I do not invest in individual stocks unless I find something with unbelievable growth, cash flow, and profit prospects.

For Simplicity I trade SSO==2X the S&P 500

For Clarity I watch the Monetary and Fiscal policies.

Example when the fed in March said they will buy ETF bond funds I Bought SSO around 85. In June when Fed said they will buy individual bonds Bought more SSO on a dip around 118. Now I trade it or sell calls when it is in the 130s and buy back on dips around 120, Easy simple and makes money.

Recently did buy a stock. NIO tremendous potential to sell electric vehicles in china. Have been to China and they desperately need to clean the air. The government is pushing electric vehicles and the people listen to the government.

It is volatile so I buy the dips and sell or sell calls on the rallies. But make sure keep some shares at all times. This fits my stock ownership criteria ” find something with unbelievable growth cash flow and profit prospects.”

As mentioned before do not follow technicals much. Except will check support and resistance to see what other traders are seeing. But always follow the fiscal and monetary policies to know direction of the markets.

With the world wide money printing machines running full time now, market can only go in one direction–up. Will be occasional dips but the huge money printing machines overwhelm the sellers and up market goes. Always buy the dips now and sell the rallies when notice a buying climax of just stay invested or sell calls

until the monetary and fiscal policies change.

That’s it for me, simplicity and clarity, and it has worked well over the years.

Howard Randall