Market X-ray - find out what's working and what's not.

Global Stock Market Indices

The market X-ray shows that US large cap stocks continue to lead the pack, up 24.0% after its 2020 gain of 18.2%. The 7 biggest stocks in the S&P 500 are tech names, and they account for 23% of the index return.

Not surprisingly, bonds are the laggard with a YTD loss of 1.9%. Bonds had a strong rally on Friday but it wasn't enough to pull them out of negative territory YTD.

The major US equity indices moved in concert, but the big disappointment so far this year has been small caps, up just 14.4% YTD after being up 21.8% last year.

Emerging Markets have disappointed this year, after good results in 2019 and 2020. Will they regain their momentum in 2022? I think they will, as long as China doesn't blow itself up.

All of the return data in this article is from Morningstar.

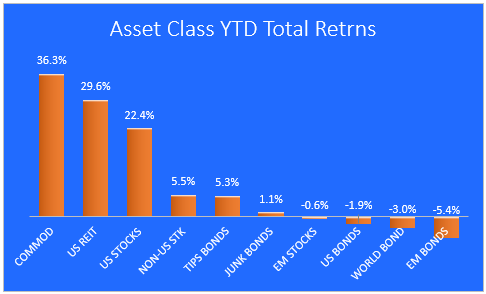

Global Asset Classes

Commodities are the most favored asset class this year. after losing -7.8% last year. Energy stocks have been leading this asset class higher. US REITs have rebounded strongly from last year's -4.7% decline.

As expected, bonds - foreign and domestic - are struggling to stay above water. And things probably won't improve next year, as central banks stop buying bonds and rates begin to rise in earnest. When adjusted for inflation, real yields are negative almost everywhere you look, and inflation could get worse.

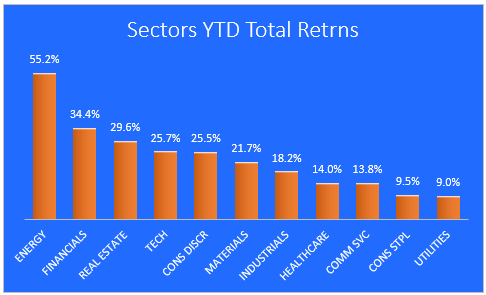

Stock Market Sectors

Energy is clearly where the action is this year, up 55.2% even after Friday's drubbing. The rebound from last year's decline of -33% is breathtaking. The same can be said for financials, up 34.4% after losing 2% last year.

Consumer Discretionary stocks led the pack last year, up 48.4%. This year they're struggling to keep up with the S&P 500 index. Consumer Staples and Utilities are lagging as investors continue to focus on "reopening" sectors.

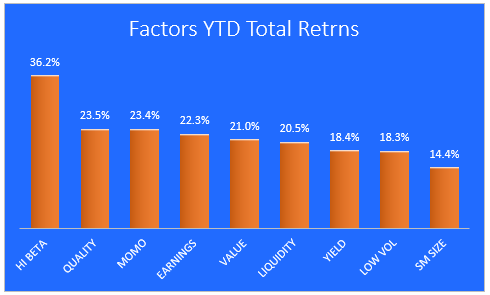

Stock Market Factors

The market X-ray shows that High-Beta stocks are the place to be this year, up 36.2%. And they were up 25.6% last year, second only to Momentum stocks, which were up 29.2% in 2020.

Money is flowing out of small cap stocks this year, and much of it is going into Value names. Low volatility is having a tough time gaining traction this year, which is a reflection of investors' preference for more speculative and high-beta names.

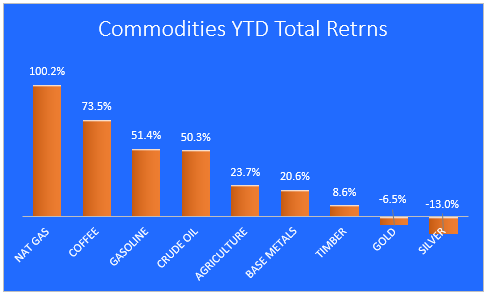

Commodities

After spending years at the bottom of the tables, Natural Gas, Gasoline, and Crude Oil now lead the pack. Gold and Silver are in last place YTD after big gains last year. One narrative that seems to be gaining popularity is that today's investors prefer crypto to gold & silver.

Investors are paying up for coffee this year. How high does the price of a cup of coffee need to go before consumers say "enough, I'm switching to tea!"?

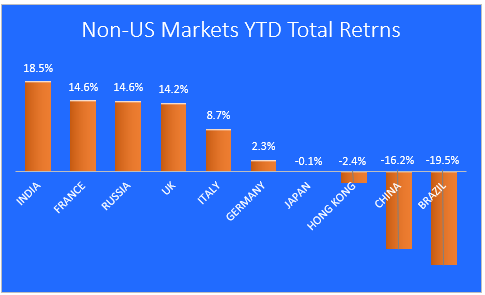

Foreign Markets

India has overtaken Russia as the hottest market this year. France is tied with Russia for 2nd place, but new Covid restrictions could dim their prospects.

There are now four countries with a negative YTD return, with China being the worst performer. Last year their market was up 28.3%. Tensions between China's leadership and the Chinese business community are increasing, and their massive property sector is still wobbly. If I had to pick a favorite for next year, it would be Japan.

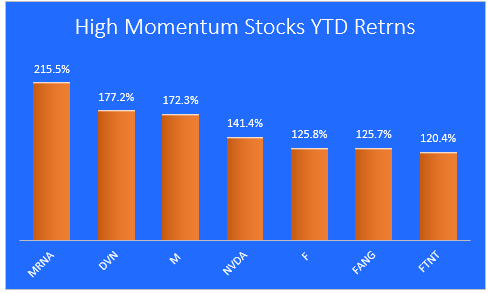

Momentum stocks

These stocks are showing strong momentum for 1 month, 3 months, and year-to-date periods. This is a small sample of where the money is going now.

It's not too late to buy MRNA, even after a 215.5% run YTD. It has a reasonable P/E and it gets high scores on StockRover for Quality, Growth, and Sentiment.

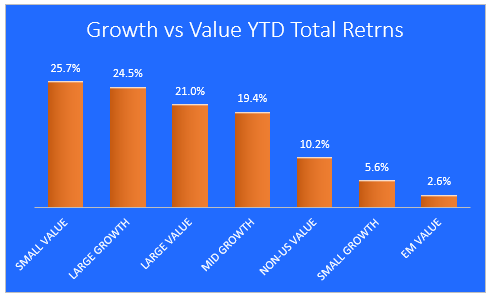

Stock Styles

The market X-ray shows that Small-cap value stocks are leading the style race this year - a surprise to me, given the poor performance of small caps in general.

Large Growth is a close second, and Emerging Market Value holds onto last place.

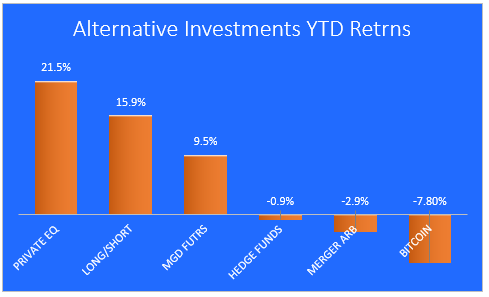

Alternative Investments

According to modern portfolio theory, adding alternative investments to your asset allocation mix can improve your risk-adjusted returns (Sharpe Ratio) and enhance your diversification. The downside is that most alternatives offer paltry returns. The upside is that they have low correlations to equities, which can help during a sharp market decline.

Final thoughts

Friday was an ugly day, but I think global stock markets will continue to rise until the FED and other central banks pull the trigger on rate increases. Investors have known this will happen for a long time, and so far they haven't been very concerned about it. That may change when the first increase becomes a reality.

I believe that gains in the remaining month of this year will be harder to come by. There are others who believe that we will see a final blowoff top that takes the S&P 500 to 4900 by the end of December.

The FED still calls the tune for the equity market, and investors largely believe that they will not allow a bear market to spoil the post-Covid party. However, the new variant Omicron, which was blamed for Friday's steep selloff, may change things dramatically if it should start to spread quickly and widely.

Congress finally passed a slimmed-down infrastructure bill, and now comes the hard part - implementation. Since our fearless leaders can't seem to agree on anything, we may not see any real benefits until mid 2022.

Regarding the stock market, watch for a series of lower lows, followed by failed attempts to make a new high. The dip-buyers may have lost the battle on Black Friday, but I think it would be unwise to count them out just yet. They have been aggressively supporting this market ever since the pandemic low point last year. If they become fully invested, their significant flow of new money into the market could stop.

Great article, just wondering, I see you picked VIAC as one of your picks for 2020. Do you think VIAC is a value trap at this point? Thanks for your comment,

Tom Goodro

If I could double down on VIAC in the Zen Ten portfolio, I would. Not a value trap but may take a while to get back on track.

Thanks for summarising all the important tidbits. The gains made in the US has been really great for me. Let's hope the rally continues for some time.

Thanks for your comment, Rajeev.