The short answer is yes. The stock market is a forward-looking, or discounting, mechanism. Stock prices today are based on what investors think will happen 6 to 12 months from now. Investors are optimistic about Trump’s pro-growth agenda. Whether he can deliver on his campaign promises is another matter, but for now the assumption among investors is that he will deliver.

The long answer is more complicated. New presidents inherit the problems and challenges left behind by their predecessors. For example, if the economy is about to go into the tank, as it was when Barack Obama was elected, there’s little the new president can do to fix it. Turning around a soft economy takes time, and this is why the first year of stock market performance under a new president is mostly based on hope, expectations, and promises, rather than hard numbers.

So the jury is still out on the issue of how much credit Trump deserves for the stock market rally we’ve seen since his election. If he delivers on his campaign promises, he deserves all of the credit. But if he fails to deliver, the market will punish him by taking away what has been gained in the past year. The market is unforgiving in that way.

This article addresses some specific questions: what has happened in the stock market when there is a change in party leadership? Does is matter to investors which party is in power? And is there a difference in stock market performance under Democrats and Republican presidents?

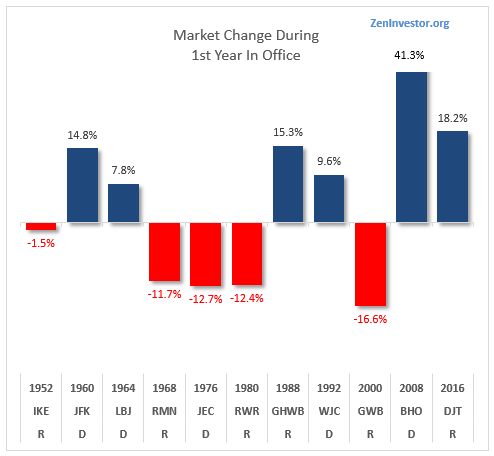

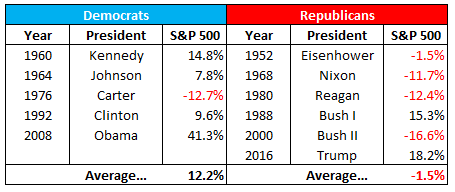

In order to focus on the impact of a change in leadership, I limited my research to the first 12 months after a party change took place. I wanted to find out how the market reacted to the initial burst of policy initiatives that every new president proposes, using the political capital that comes from wresting control of the levers of power from the opposing party.

It’s important to note that I don’t have a dog in this fight. I let the numbers speak for themselves.

First, some ground rules. I limited my research to the “modern era” – from 1952 to present day. I did so because I wanted to avoid two world wars, the Great Depression and anything that pre-dated the establishment of the Federal Reserve. In other words, I wanted to limit my research to the election of presidents to whom I can relate. (I was in grade school when Eisenhower was elected, and I can remember seeing “I Like Ike!” banners, yard signs and buttons everywhere. I didn’t know what it all meant, but I could see that people were going crazy for the guy.)

Next, I only looked at elections where the occupant of the White House changed. I figured that if we re-elected a president for a second term, it meant that things were going well and I wasn’t interested in how the market reacted to it. But the rise of a new leader is a big deal, and I wanted to know what happened to the market when there was a changing of the guard.

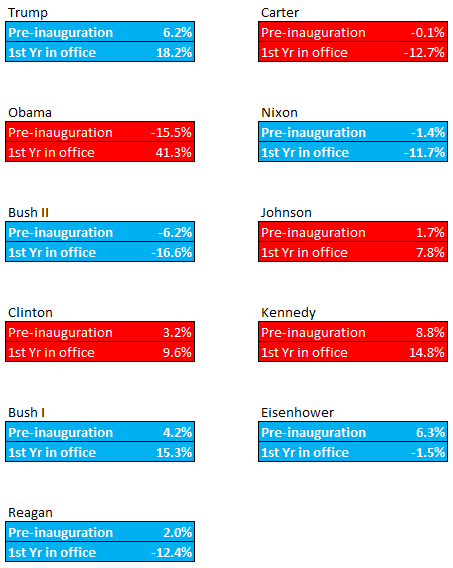

I struggled with the time frame. I eventually settled on the period starting on Election Day in November, through the first 12 months of the new president’s term. That gave me a total of 14 months of market action to look at. Even though the new commander-in-chief doesn’t actually start the job until January 20th, the stock market is a forward-looking mechanism. So as far as the market is concerned, Election Day is the beginning of the new regime, notwithstanding the formality of the inauguration.

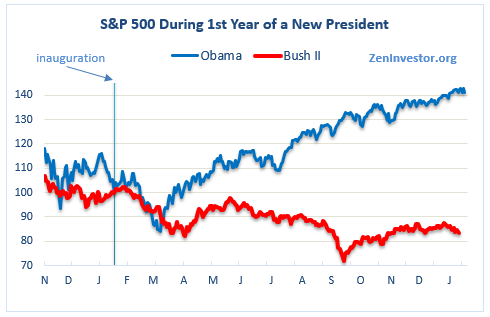

In order to draw attention to the period between Election Day and inauguration day, and to make each episode consistent, I drew the charts so that they all start at a base of 100 on inauguration day. That way we can see what happened between Election Day and the start of the term, and then we can compare market performance on an apples-to-apples basis for the first full year of the new president’s reign. The market performance comparison is from inauguration day on January 20th to January 20th of the following year – 12 full months.

Conventional wisdom suggests that Republican administrations, which are ideologically more business-friendly than Democratic administrations, would be more bullish for the stock market. But a review of the record since 1950 shows something different. History shows that the stock market does better, by a considerable margin, when the occupant in the White house changes from a Republican to a Democrat. Again, I’ll leave it up to the reader to determine why this is so.

The market has averaged a gain of 12.2% during the first year of a Democratic administration. For Republicans, the market has produced a loss of -1.5% on average. That’s a stark contrast. Now let’s look at the numbers for each party separately.

Final thoughts

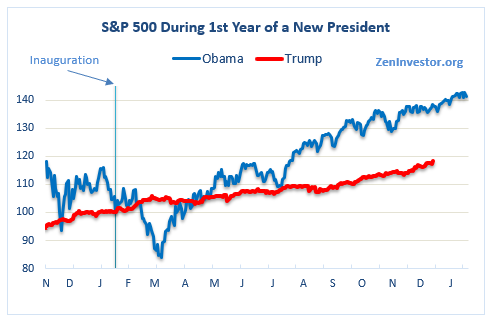

President Trump deserves credit for the 18% stock market rally since his rise to power. As with any new president, much of this action is based on hopes and expectations, rather than hard numbers. Investors have clearly given Trump the benefit of the doubt by pricing in a successful growth agenda.

Investors weren’t so kind to President Obama. When he took office, the financial system was melting down and investors did not believe that Obama could save the day. But in time, the financial system and the economy began to recover, and the stock market found a bottom. Obama’s first year in office was accompanied by a 41% gain in the stock market.

Trump’s stock market is trailing Obama’s so far, but it is also the best 1st year performance for a Republican since 1952.